In this video I answer a question I received from a viewer. They want to know about mathematics for quantitative finance. They are specifically concerned with math for real analysis and probability. Do you have any advice or opinions? If so, please leave a comment. Quantative Finance Bo

From playlist Inspiration and Advice

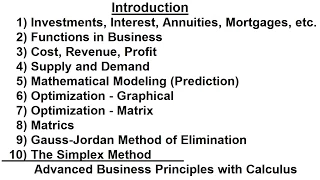

Business Math (1 of 1) Introduction

Visit http://ilectureonline.com for more math and science lectures! In this video I will introduce the topics that will be covered in Business Math – investments, interest, annuities, mortgages, functions in business, cost, revenue, profit, supply and demand, predictions, optimization, ma

From playlist BUSINESS MATH 1 - INTRODUCTION

Michael Joswig - What is Mathematical Software

What Is Mathematical Software? A short answer to this question is: Mathematical Software is what mathematics receives as a benefit from the digital age. This is relevant because Mathematical Software is useful in many ways. For instance, Mathematical Software serves as a tool to support

From playlist Research Spotlight

Quantum Mechanics -- a Primer for Mathematicians

Juerg Frohlich ETH Zurich; Member, School of Mathematics, IAS December 3, 2012 A general algebraic formalism for the mathematical modeling of physical systems is sketched. This formalism is sufficiently general to encompass classical and quantum-mechanical models. It is then explained in w

From playlist Mathematics

Definitions, specification and interpretation | Arithmetic and Geometry Math Foundations 44

We discuss important meta-issues regarding definitions and specification in mathematics. We also introduce the idea that mathematical definitions, expressions, formulas or theorems may support a variety of possible interpretations. Examples use our previous definitions from elementary ge

From playlist Math Foundations

Excel Finance Class 08: Intro To Corporate Financial Management

Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch01.pdf Download article: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233FreeEfficientRational.pdf Learn about The definition of finance, the goal of finance, the drawbacks of the goal of fina

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

Using Algebra and Geometry in the Real World

You hear terms like “algebra” and “geometry” and these theories we memorized in high school start to dance a jig in our heads – a jig many of us weren’t overly interested in! But the past decade has seen an explosion of applications of algebra, geometry, and topology to the real world, lik

From playlist What is math used for?

Visualizing decimal numbers and their arithmetic 67 | Arithmetic and Geometry Math Foundations

This video gives a precise definition of a decimal number as a special kind of rational number; one for which there is an expression a/b where a and b are integers, with b a power of ten. For such a number we can extend the Hindu-Arabic notation for integers by introducing the decimal form

From playlist Math Foundations

MBA in Finance Full Details | Why MBA in Finance? | Jobs in MBA Finance | Simplilearn

This video on MBA in Finance: Full Details will aid you in understanding the intricate details about MBA in finance specialization. With this Why MBA in Finance? tutorial, you will learn why finance is the most sought-after MBA specialization. You will also delve over the details about Eli

From playlist Business And Management 🔥[2022 Updated]

Ses 1: Introduction and Course Overview

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Math, Finance & Decisions: Career Paths in Financial Services - Margaret Holen

Spring Opportunities Workshop 2023 Topic: Math, Finance & Decisions: Career Paths in Financial Services Speaker: Margaret Holen Affiliation: Princeton University Date: January 13, 2023 We face financial choices every day. From buying a morning coffee, to an online shopping errand in the

From playlist Spring Opportunities Workshop 2023

Anne-Sandrine Paumier - Quel(s) lieu(x) pour quelle(s) mathématique(s) ?

Quel(s) lieu(x) pour quelle(s) mathématique(s) ? Penser et construire l’Institut de Hautes Études Scientifiques Conférence donnée devant L'Association des Amis de l'IHES à l'IHES le 4 mai 2017. L’IHES est créé officiellement le 27 juin 1958, dans le bureau de Joseph Pérès, doyen de la Fa

From playlist Évenements grand public

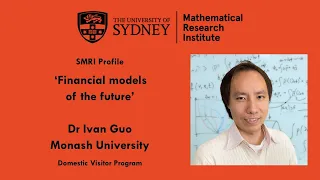

Ivan Guo: Financial models of the future

Dr Ivan Guo's research lies predominantly in the areas of stochastic control and financial mathematics. In this interview, he reflects on his SMRI visit and explains the models behind financial mathematics. Find out how transport theory applies to quantitative finance (as well as logisti

From playlist SMRI Interviews

1. Introduction and What this Course Will Do for You and Your Purposes

Financial Markets (2011) (ECON 252) Professor Shiller provides a description of the course, including its general theme, the relevant textbooks, as well as the interplay of his course with Professor Geanakoplos's course "Economics 251--Financial Theory." Finance, in his view, is a pillar

From playlist Financial Markets (2011) with Robert Shiller

1. Introduction, Financial Terms and Concepts

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013 View the complete course: http://ocw.mit.edu/18-S096F13 Instructor: Peter Kempthorne, Choongbum Lee, Vasily Strela, Jake Xia In the first lecture of this course, the instructors introduce key terms and concepts rela

From playlist MIT 18.S096 Topics in Mathematics w Applications in Finance

AIUK: Machine learning for finance

From the algorithms responsible for credit decision making to the intuitive technology protecting us from fraud – some of the earliest adoption of AI-driven processes have come from the financial and economic sector. Today, it continues to be a main driver for opportunity in the financial

From playlist AIUK 2021

Tanya Beder: "The Here-to-Stay Roles of Big Data and Machine Learning"

National Meeting of Women in Financial Mathematics Tanya Beder: "The Here-to-Stay Roles of Big Data and Machine Learning" Institute for Pure and Applied Mathematics, UCLA April 27, 2017 For more information: http://www.ipam.ucla.edu/programs/special-events-and-conferences/national-meeti

From playlist National Meeting of Women in Financial Mathematics 2017

Andrew Lo: "Can Financial Engineering Cure Cancer? A New Approach to Funding Biomedical Innovation"

Green Family Lecture Series 2015, Public Lecture "Can Financial Engineering Cure Cancer? A New Approach to Biomedical Innovation" Andrew W. Lo, Massachusetts Institute of Technology Institute for Pure and Applied Mathematics, UCLA May 18, 2015 For more information: https://www.ipam.ucla

From playlist Public Lectures

Partial Sums (1 of 2: Adding up terms in an arithmetic progression)

More resources available at www.misterwootube.com

From playlist Modelling Financial Situations