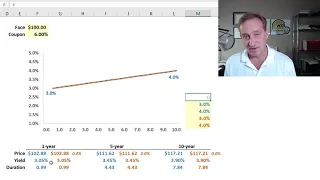

Yield curve

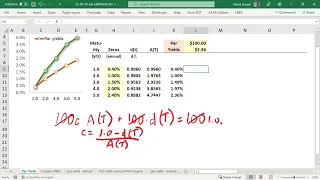

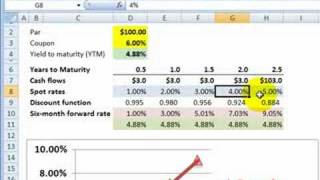

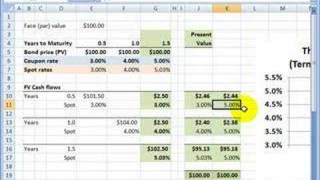

In finance, the yield curve is a graph which depicts how the yields on debt instruments - such as bonds - vary as a function of their years remaining to maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity. According to finance scholar Dr. Frank J. Fabozzi, investors use yield curves to price debt securities traded in public markets and to set interest rates on many other types of debt, including bank loans and mortgages. Shifts in the shape and slope of the yield curve are thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics of a properly constructed yield curve. It should be based on a set of securities which have differing lengths of time to maturity, and all yields should be calculated as of the same point in time. All securities measured in the yield curve should have similar credit ratings, to screen out the effect of yield differentials caused by credit risk. For this reason, many traders closely watch the yield curve for U.S. Treasury debt securities, which are considered to be risk-free. Informally called "the Treasury yield curve", it is commonly plotted on a graph such as the one on the right. More formal mathematical descriptions of this relationship are often called the term structure of interest rates. (Wikipedia).