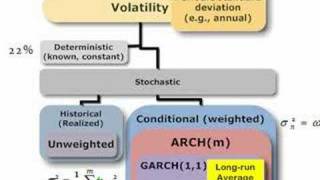

Lots of ways to estimate volatility. In this map, I parse out implied volatility (forward looking) and deterministic (constant) and focus on stochastic volatility: volatility that changes over time, either via (conditional) recent volatility and/or random shocks. For more financial risk vi

From playlist Volatility

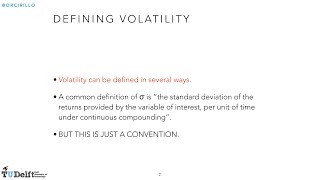

Risk Management Lesson 4A: Volatility

First part of Lesson 4. Topics: - Definitions of volatility - Basic assumptions (do they hold?) - Arch and G-arch models (brief overview)

From playlist Risk Management

What are Volatility Swaps? Financial Derivatives - Trading Volatility

In todays class we learn about what a volatility swap is. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https:/

From playlist The Term Structure of Volatility

Volatility Trading - Call and Put Options - Trading Tutorial

These classes are all based on the book Derivatives For The Trading Floor, available on Amazon at this link. https://amzn.to/3GdLi2s Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle What is volatility trading? Volatility

From playlist Class 4 The Greeks & Dynamic Hedging

IDTIMWYTIM: Stochasticity - THAT'S Random

Hank helps us understand the difference between the colloquial meaning of randomness, and the scientific meaning, which is also known as stochasticity. We will learn how, in fact, randomness is surprisingly predictable. Like SciShow: http://www.facebook.com/scishow Follow SciShow: http://

From playlist Uploads

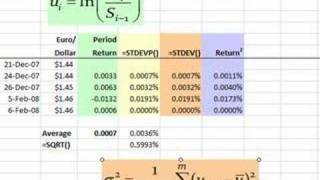

FRM: Volatility: Moving Average Approaches

Within stochastic volatility, moving average is the simplest approach. It simply calculates volatility as the unweighted standard deviation of a window of X trading days. Here I show the three "flavors:" population variance (volatility = SQRT[variance]), sample, and simple. For more financ

From playlist Volatility

Risk Management Lesson 4B: Volatility (second part) and Coherent Risk Measures

This is the second half of Lesson 4. Topics: - Exercise about volatility modeling with G-arch - Coherent risk measures - Are the variance and the standard deviation coherent? A useful document for you is available here: https://www.dropbox.com/s/6pdygf0bw6bcce1/coherence.pdf

From playlist Risk Management

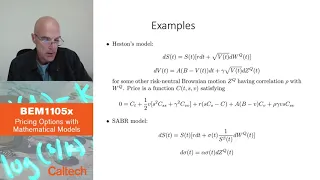

8 2 Stochastic Volatility Part 2

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Introduction to the paper https://arxiv.org/abs/2002.06707

From playlist Research

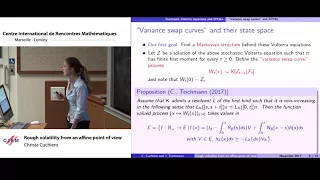

Christa Cuchiero: Rough volatility from an affine point of view

Abstract: We represent Hawkes process and their Volterra long term limits, which have recently been used as rough variance processes, as functionals of infinite dimensional affine Markov processes. The representations lead to several new views on affine Volterra processes considered by Abi

From playlist Probability and Statistics

Time Varying Volatility and GARCH in Risk Management

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle In Todays video let's learn abo

From playlist Risk Management

Grégoire Loeper: Reconstruction by optimal transport: applications in cosmology and finance

Abstract: Following the seminal work by Benamou and Brenier on the time continuous formulation of the optimal transport problem, we show how optimal transport techniques can be used in various areas, ranging from "the reconstruction problem" cosmology to a problem of volatility calibration

From playlist Mathematics in Science & Technology

Dylan Possamaï: Principal Agent Modelling - lecture 3

CIRM HYBRID EVENT These lectures will consist in an overview of recent progresses made in contracting theory, using the so-called dynamic programming approach. The basic situation is that of a Principal wanting to hire an Agent to do a task on his behalf, and who has to be properly incenti

From playlist Probability and Statistics

George Papanicolaou: Stochastic Analysis in Finance

This lecture was held at The University of Oslo, May 24, 2007 and was part of the Abel Prize Lectures in connection with the Abel Prize Week celebrations. Program for the Abel Lectures 2007 1. “A Short History of Large Deviations” by Srinivasa Varadhan, Abel Laureate 2007, Courant Ins

From playlist Abel Lectures

"Diffusion Approximation and Sequential Experimentation" by Victor Araman

We consider a Bayesian sequential experimentation problem. We identify environments in which the average number of experiments that is conducted per unit of time is large and the informativeness of each individual experiment is low. Under such regimes, we derive a diffusion approximation f

From playlist Thematic Program on Stochastic Modeling: A Focus on Pricing & Revenue Management

Risk Management of Option Books with Arbitrage-Free Neural-SDE Market Models (SIAM FME)

SIAM Activity Group on FME Virtual Talk Series Join us for a series of online talks on topics related to mathematical finance and engineering and running every two weeks until further notice. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Spe

From playlist SIAM Activity Group on FME Virtual Talk Series

Adam Jakubowski: Functional convergence for dependent heavy-tailed models

Find this video and other talks given by worldwide mathematicians on CIRM's Audiovisual Mathematics Library: http://library.cirm-math.fr. And discover all its functionalities: - Chapter markers and keywords to watch the parts of your choice in the video - Videos enriched with abstracts, b

From playlist Probability and Statistics

For those asking me to go through Stoichiometry a bit slower... https://www.youtube.com/playlist?list=PLyuGdIuwJD9G2pZrJmSa57awLilGCyOCZ These are updated videos (currently using for Australian Curriculum) that take you from mass to solution to gas Stoichiometry.

From playlist Topic 1 Stoichiometry - at a slower pace...