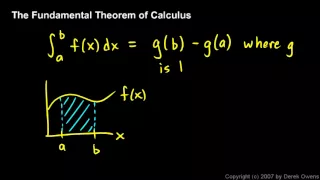

Calculus - The Fundamental Theorem, Part 1

The Fundamental Theorem of Calculus. First video in a short series on the topic. The theorem is stated and two simple examples are worked.

From playlist Calculus - The Fundamental Theorem of Calculus

The Second Fundamental Theorem of Calculus

This video introduces and provides some examples of how to apply the Second Fundamental Theorem of Calculus. Site: http://mathispower4u.com

From playlist The Second Fundamental Theorem of Calculus

Calculus: The Fundamental Theorem of Calculus

This is the second of two videos discussing Section 5.3 from Briggs/Cochran Calculus. In this section, I discuss both parts of the Fundamental Theorem of Calculus. I briefly discuss why the theorem is true, and work through several examples applying the theorem.

From playlist Calculus

Ex 1: The Second Fundamental Theorem of Calculus

This video provides an example of how to apply the second fundamental theorem of calculus to determine the derivative of an integral. Site:http://mathispower4u.com

From playlist The Second Fundamental Theorem of Calculus

What is the Fundamental theorem of Algebra, really? | Abstract Algebra Math Foundations 217

Here we give restatements of the Fundamental theorems of Algebra (I) and (II) that we critiqued in our last video, so that they are now at least meaningful and correct statements, at least to the best of our knowledge. The key is to abstain from any prior assumptions about our understandin

From playlist Math Foundations

Evaluate the integral with e as the lower bound

👉 Learn about the fundamental theorem of calculus. The fundamental theorem of calculus is a theorem that connects the concept of differentiation with the concept of integration. The theorem is basically saying that the differentiation of the integral of a function yields the original funct

From playlist Evaluate Using The Second Fundamental Theorem of Calculus

Learn to evaluate the integral with functions as bounds

👉 Learn about the fundamental theorem of calculus. The fundamental theorem of calculus is a theorem that connects the concept of differentiation with the concept of integration. The theorem is basically saying that the differentiation of the integral of a function yields the original funct

From playlist Evaluate Using The Second Fundamental Theorem of Calculus

The Fundamental Theorem of Calculus | Algebraic Calculus One | Wild Egg

In this video we lay out the Fundamental Theorem of Calculus --from the point of view of the Algebraic Calculus. This key result, presented here for the very first time (!), shows how to generalize the Fundamental Formula of the Calculus which we presented a few videos ago, incorporating t

From playlist Algebraic Calculus One

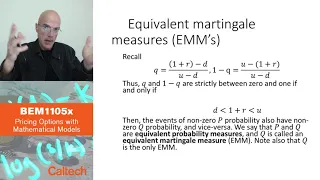

4 6 Fundamental theorems of asset pricing Part 2

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

FinMath L3-2: Risk-neutral measures and self-financing portfolios

Welcome to Lesson 3 of Financial Mathematics (Part 2). In this second half of the lesson, we discuss important topics like self-financing portfolio, risk neutral measures and their basic properties, and the concept of arbitrage. All these tools are essential in financial mathematics, and t

From playlist Financial Mathematics

Fin Math L4-2: The two fundamental theorems of asset pricing and the exponential martingale

Welcome to the second part of Lesson 4 of Financial Mathematics. In this video we discuss the two fundamental theorems of asset pricing and we introduce the exponential martingale, an essential tool that we will use as the Radon-Nikodym derivative to move from P to Q in the Cameron-Martin

From playlist Financial Mathematics

Fin Math L5-3: Towards Black-Scholes-Merton

Welcome to the last part of Lesson 5. In this video we cover some last relevant topics to finally deal with the Black-Scholes-Merton theorem, which will be the starting point of all our pricing exercises. Here you can download the new chapter of the lecture notes: https://www.dropbox.com/s

From playlist Financial Mathematics

Fin Math L4-1: Change of measure and the Radon-Nikodym derivative

Welcome to Lesson 4 of Financial Mathematics. In this first part of our lesson we deal with the change of measure, a fundamental operation to guarantee the possibility of finding a proper risk-neutral measure. We therefore introduce Radon-Nikodym derivatives and other related concepts. To

From playlist Financial Mathematics

Twenty second SIAM Activity Group on FME Virtual Talk Series

Join us for a series of online talks on topics related to mathematical finance and engineering and running every two weeks until further notice. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Date: Thursday, October 7, 2021, 1PM-2PM Speaker

From playlist SIAM Activity Group on FME Virtual Talk Series

4 5 Fundamental theorems of asset pricing Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Prof. Frank Riedel - Frank Knight, the Economics of Uncertainty, and 21st Century Finance

A workshop to commemorate the centenary of publication of Frank Knight’s "Risk, Uncertainty, and Profit" and John Maynard Keynes’ “A Treatise on Probability” This workshop is organised by the University of Oxford and supported by The Alan Turing Institute. For further details and regular

From playlist Uncertainty and Risk

4. Efficiency, Assets, and Time

Financial Theory (ECON 251) Over time, economists' justifications for why free markets are a good thing have changed. In the first few classes, we saw how under some conditions, the competitive allocation maximizes the sum of agents' utilities. When it was found that this property didn'

From playlist Financial Theory with John Geanakoplos

Fin Math L6-2: Pricing a EU call and Historical Volatility.

Welcome to the second part of Lesson 6 of Financial Mathematics. $How can we price a European call, now that we known the Black-Scholes-Merton theorem? What can we say about σ, i.e. volatility? Topics: 00:00 Pricing a EU call 12:28 Volatility in the BSM framework 15:06 Historical volatil

From playlist Financial Mathematics