Deductions vs Credit Calculator 1

From playlist Personal Finance

How To Calculate Your Mortgage Payment

This finance video tutorial explains how to calculate your monthly mortgage payment using the amortization formula. All you need is the principal loan balance, the loan term, and the fixed annual interest rate.

From playlist Personal Finance

Loss distribution for credit enhancement in securitization

This continues to follow the subprime securitization case study by Aschraft. There are two steps: 1. Specify the loss distribution; and 2. Map the target credit rating to the implied credit enhancement

From playlist Credit Risk: Securitization

Deductions vs Credit Calculator 2

From playlist Personal Finance

Determining The Value of an Annuity

This video defines an annuity and uses a formula to determine the value of an annuity over a period of time. http://mathispower4u.wordpress.com/

From playlist Financial Math

Redesigning over-the-counter financial markets 1/2

Distinguished Visitor Lecture Series Redesigning over-the-counter financial markets Darrell Duffie Stanford University, USA

From playlist Distinguished Visitors Lecture Series

Write a Differential Equation to Model the Change in a Bank Account: Changing Deposit Amount

This video explains how to write a differential equation to model the change in the balance of an bank account that pay continuous interest and the deposit amounts increase continuously. http://mathispower4u.com

From playlist Applications of First Order Differential Equations

The Installment Loan Formula: Determining Remaining Balance

This lesson explains how to determine the remaining balance of an installment load after a certain number of years. Site: http://mathispower4u.com

From playlist Financial Math

Challenges in Bail-In Operationalisation

Daniel Willam, Treasury Regulation, Deutsche Bank, joins the RiskMinds Regulation Digital Week to discusses some of the key concerns and steps for consideration for bail-in operationalisation. To read Daniel's blog piece supporting this webinar, and see more from the RiskMinds Regulation

From playlist RiskMinds Regulation Digital Week

Darwinian Model Risk and Reverse Stress Testing

SIAM Activity Group on FME Virtual Talk Series Join us for a series of online talks on topics related to mathematical finance and engineering and running every two weeks until further notice. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Dat

From playlist SIAM Activity Group on FME Virtual Talk Series

FRM: Valuation of credit default swap (CDS)

The key idea in valuing a CDS is a fair deal: the (probability-adjusted) expected PAYMENTS (i.e., made by protection buyer) should equal the expected PAYOFF (contingent, made by seller). For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Derivatives: Credit Derivatives

In this video, we look at a basic return on investment calculation.

From playlist Personal Finance

Determine the final value for Compound interest problems

Learn about compound interest. We will look at how to determine the final value, initial value, interest rate and years needed. We will investigate problems compounded continuously, daily, weekly, monthly, quarterly and yearly. These changes will impact our problems as well as the time we

From playlist Compound Interest

2012 FRM Credit Risk Measurement & Management T6.b

This is a sample of our 2012 FRM Credit Risk Measurement & Management T6.b video tutorials. You may view our products here: https://www.bionicturtle.com/products/financial-risk-management/ The Bionic Turtle program is the most effective and affordable preparation aid for the Financial Ri

From playlist FRM

2012 FRM Valuation & Risk Models T4.e

This is a sample of our 2012 FRM Valuation & Risk Models T4.e video tutorials. You may view our products here: https://www.bionicturtle.com/products/financial-risk-management/ The Bionic Turtle program is the most effective and affordable preparation aid for the Financial Risk Manager (F

From playlist FRM

Mod-05 Lec-09 Inventory Valuation, Cash Flow

Managerial Accounting by Dr. Varadraj Bapat,Department of Management,IIT Bombay.For more details on NPTEL visit http://nptel.ac.in

From playlist IIT Bombay: Managerial Accounting | CosmoLearning.org Accounting

XVA desks in a post-Covid world: Brave new world or back to basics?

In 2020, when entire economies shut down, risk managers’ radars instantly picked up on the heightened financial risks. The same turbulence in the market also added new dimensions to the XVA desk – an already complex mission with regulatory, business, and technological elements to consider.

From playlist Webinars: At home with the experts

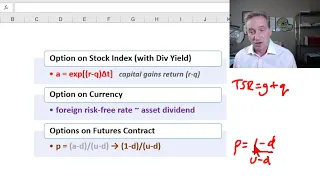

Binomial option pricing model for equity index, currencies, and futures options (FRM T4-9)

[here is my xls https://trtl.bz/2AZLCkA] Using a three-step binomial to price "options on other assets" (Hull 13.11 10th edition): equity index option, currency options and futures options (aka, options on futures contracts). The key difference is the calculation of p = probability of an u

From playlist Valuation and RIsk Models (FRM Topic 4)

Applied Portfolio Management - Class 3 - Equity Investment Management

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance In todays video we learn about equity investment management. We learn about how a portfolio manager builds a portfolio. We learn about the efficient market hypothesis, macroeconomic analysis, the

From playlist Applied Portfolio Management

Reducing Balance Loans (1 of 2: Why are reducing balance loans important for mortgages)

More resources available at www.misterwootube.com

From playlist Investments and Loans