Intoduction to Financial Modeling | Financial Modeling Tutorial | What is Financial Modeling

This Financial Modeling tutorial helps you to learn financial modeling with examples. This video is ideal for beginners to learn the basics of financial modeling. To attend a live session, click here: http://goo.gl/0vZIOF This video helps you learn: • Why Financial Modeling ? • Cours

From playlist Financial Modeling Tutorial Videos

Getting Started with Financial Modeling | Financial Modeling Tutorial | What is Financial Modeling

This Financial Modeling tutorial helps you to learn financial modeling with examples. This video is ideal for beginners to learn the basics of financial modeling. To attend a live session, click here: http://goo.gl/1fclPr This video helps you learn: • Why Financial Modeling ? • Cours

From playlist Financial Modeling Tutorial Videos

Data Modeling Tutorial | Data Modeling for Data Warehousing | Data Warehousing Tutorial | Edureka

***** Data Warehousing & BI Training: https://www.edureka.co/data-warehousing-and-bi ***** Data modeling is a process used to define and analyze data requirements needed to support the business processes within the scope of corresponding information systems in organizations. Therefore, th

From playlist Data Warehousing Tutorial Videos

Putting it Together How to Value a Company - Financial Modeling | Simplilearn

🔥Explore Our Free Courses With Completion Certificate by SkillUp: https://www.simplilearn.com/skillup-free-online-courses?utm_campaign=HowToValueACompany&utm_medium=DescriptionFirstFold&utm_source=youtube This video explains the: 1.Backward Looking Accounting Based Valuation Techniques 2.F

From playlist Financial Modeling Course

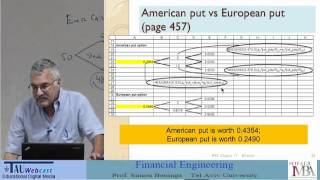

Lecture 5: Introduction to Monte Carlo in Finance

Lecturer: Prof. Shimon Benninga Tel Aviv University 2.8.11

From playlist Financial Modeling (Simon Benniga)

Lecture 1: Portfolio Choice with Multiple Assets

Lecturer: Prof. Shimon Benninga Tel Aviv University 5.7.11

From playlist Financial Modeling (Simon Benniga)

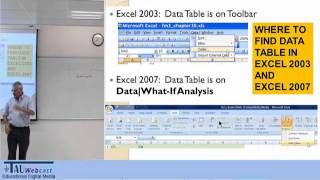

Lecture 4: Random Numbers; Binomial Model

Lecturer: Prof. Shimon Benninga Tel Aviv University 26.7.11

From playlist Financial Modeling (Simon Benniga)

Introduction to Valuation Modeling - FM | Simplilearn

🔥Explore Our Free Courses With Completion Certificate by SkillUp: https://www.simplilearn.com/skillup-free-online-courses?utm_campaign=IntroToValuationModeling&utm_medium=DescriptionFirstFold&utm_source=youtube This video explains the: 1.Understanding Integrated Financial Models 2.Scenario

From playlist Financial Modeling Course

Excel Finance Class 08: Intro To Corporate Financial Management

Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch01.pdf Download article: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233FreeEfficientRational.pdf Learn about The definition of finance, the goal of finance, the drawbacks of the goal of fina

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

1. Finance, Growth, and Volatility

MIT 14.772 Development Economics: Macroeconomics, Spring 2013 View the complete course: http://ocw.mit.edu/14-772S13 Instructor: Robert Townsend Prof. Townsend introduces the course to the students, explains the syllabus, and covers the topics of finance, growth, and volatility. Chapters

From playlist MIT 14.772 Development Economics: Macroeconomics, Spring 2013

Ivan Guo: Financial models of the future

Dr Ivan Guo's research lies predominantly in the areas of stochastic control and financial mathematics. In this interview, he reflects on his SMRI visit and explains the models behind financial mathematics. Find out how transport theory applies to quantitative finance (as well as logisti

From playlist SMRI Interviews

Modern finance and Macroeconomics: connecting various threads by Srinivas Raghavendra

Modern Finance and Macroeconomics: A Multidisciplinary Approach URL: http://www.icts.res.in/program/memf2015 DESCRIPTION: The financial meltdown of 2008 in the US stock markets and the subsequent protracted recession in the Western economies have accentuated the need to understand the dy

From playlist Modern Finance and Macroeconomics: A Multidisciplinary Approach

Decoding Financial Literacy Using Customer Feedback

Install NLP Libraries https://www.johnsnowlabs.com/install/ Register for Healthcare NLP Summit 2023: https://www.nlpsummit.org/#register Watch all NLP Summit 2022 sessions: https://www.nlpsummit.org/nlp-summit-2022-watch-now/ Presented by Anjali Sreekumar, Manager, Software Engineerin

From playlist NLP Summit 2022

Valuation Modelling | Financial Modelling Training | Financial Modelling Tutorial | Simplilearn

🔥 Explore Best Courses By Simplilearn: https://www.simplilearn.com/?utm_campaign=ValuationModeling-y0t4uw0FWI4&utm_medium=DescriptionFirstFold&utm_source=youtube Basic valuation techniques are as follows 1. Past performance: Past performance informs us on the historical average level of t

From playlist Microsoft Excel Tutorial Videos 🔥[2022 Updated]

Public lecture 1 - Jean-Philippe Bouchaud “Crises économiques et financières : un point de vue...

Public lecture 1 - Jean-Philippe Bouchaud “Crises économiques et financières : un point de vue de physicien” « The Economic Crisis is a Crisis for Economic Theory » a récemment écrit Alan Kirman. La théorie en question affirme que les agents sont rationnels et les marchés sont « efficien

From playlist T1-2015 : Disordered systems, random spatial processes and some applications

What is Math Modeling? Video Series Part 5: Getting a Solution

Mathematical modeling uses math to represent, analyze, make predictions, or otherwise provide insight into real world phenomena. This episode, number five in this new seven-part series, guides you through the process of finding a solution to your mathematical model. Here’s where you’ll fi

From playlist M3 Challenge

Introducing Spark NLP for Finance and Legal

Install NLP Libraries https://www.johnsnowlabs.com/install/ Register for Healthcare NLP Summit 2023: https://www.nlpsummit.org/#register Watch all NLP Summit 2022 sessions: https://www.nlpsummit.org/nlp-summit-2022-watch-now/ This keynote introduces the two most recent additions to th

From playlist NLP Summit 2022