7. Behavioral Finance: The Role of Psychology

Financial Markets (ECON 252) Behavioral Finance is a relatively recent revolution in finance that applies insights from all of the social sciences to finance. New decision-making models incorporate psychology and sociology, among other disciplines, to explain economic and financial phen

From playlist Financial Markets (2008) with Robert Shiller

In this video I answer a question I received from a viewer. They want to know about mathematics for quantitative finance. They are specifically concerned with math for real analysis and probability. Do you have any advice or opinions? If so, please leave a comment. Quantative Finance Bo

From playlist Inspiration and Advice

QRM L1-1: The Definition of Risk

Welcome to Quantitative Risk Management (QRM). In this first class, we define what risk if for us. We will discuss the basic characteristics of risk, underlining some important facts, like its subjectivity, and the impossibility of separating payoffs and probabilities. Understanding the d

From playlist Quantitative Risk Management

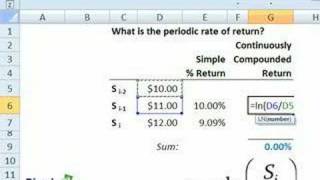

Intro to Quant Finance: Periodic Rate of Return

Periodic rate of return

From playlist Intro to Quant Finance

What is a Quant Trader? | Systematic Investing | What is a Quant Hedge Fund? | Trading Ideas

Todays video is all about quant trading or investing. I have been a quantitative trader for over twenty years, and one of the most frequent questions I get in the comments section of my videos is what does a quant trader or quant hedge fund investor actually do. In this video we will tal

From playlist Statistics For Traders

Volatility: standard deviation (FRM T2-21)

[Here is my xls at https://trtl.bz/2kOmHb6] The simple, common approach to estimating volatility is historical standard deviation. Here is a thread about the decision to include/exclude the mean return: https://trtl.bz/2kLRK7z. Discuss this video here in our forum: https://trtl.bz/2HMhjk2

From playlist Quantitative Analysis (FRM Topic 2)

Prospect Theory and Stock Market Anomalies - L. Jin - 1/31/2020

"Prospect Theory and Stock Market Anomalies" Lawrence Jin, Assistant Professor of Finance, Caltech Abstract: This talk discusses some recent development in the field of behavioral finance, with a focus on a new model of asset prices in which investors evaluate risk according to prospect t

From playlist HSS Caltech + Finance 2020

Top Ten Finance Books For Traders & Investors

Today's video is a list of my top ten books for traders, or the best finance Books to read to learn about the financial industry. I decided to come up with a list of books that are not just filled with knowledge, but that are also really enjoyable reads – the kind of book that it is hard

From playlist Top Ten Lists

Strata Jumpstart 2011: Cathy O'Neil, "What Kinds of People are Needed for Data Management?"

Cathy O'Neil (Intent Media), "What Kinds of People and Processes are Needed for Data Management and Analytics?"

From playlist Strata NY 2011

Welcome to Quantitative Risk Management (QRM). In this lesson we introduce the axiomatic approach to risk measures. We give the definition of risk measure and we discuss what its uses for us are in terms of reserve capital quantification. We then define coherent and convex measures. The p

From playlist Quantitative Risk Management

16. The Evolution and Perfection of Monetary Policy

Financial Markets (ECON 252) Central Banks, originally created as bankers' banks, implement monetary policy using their leverage over the supply of money and credit standards. Since the Bank of England was founded in 1694, through the gold standard which lasted until the 1930s, and into

From playlist Financial Markets (2008) with Robert Shiller

More on Quantitative Easing (and Credit Easing)

Courses on Khan Academy are always 100% free. Start practicing—and saving your progress—now: https://www.khanacademy.org/economics-finance-domain/core-finance/money-and-banking/federal-reserve/v/more-on-quantitative-easing-and-credit-easing Understanding the difference between quantitati

From playlist Money, banking and central banks | Finance and Capital Markets | Khan Academy

Applied Portfolio Management - Video 4 - Fixed Income Asset Management

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest

From playlist Applied Portfolio Management

The Story of James Simons - Renaissance Technologies & Medallion Fund

Jim Simons is a mathematician and cryptographer who realized that the complex math he used to break military codes could also explain patterns in the world of finance. James Simons has been described as "the world's smartest billionaire", amassing a fortune through the clever use of mathem

From playlist Statistics For Traders

Serve banking customers by leveraging Natural Language Processing

Presented by: Andy Li – Director in Enterprise AI COE at Wells Fargo In this talk, Andy Li will focus on discussing how they use NLP to understand customer needs and enhance customer experiences at Wells Fargo. He will also discuss some NLP use cases and focus on building an NLP based eco

From playlist NLP Summit 2021

Dependence Uncertainty and Risk - Prof. Paul Embrechts

Abstract I will frame this talk in the context of what I refer to as the First and Second Fundamental Theorem of Quantitative Risk Management (1&2-FTQRM). An alternative subtitle for 1-FTQRM would be "Mathematical Utopia", for 2-FTQRM it would be "Wall Street Reality". I will mainly conce

From playlist Uncertainty and Risk

Public lecture 1 - Jean-Philippe Bouchaud “Crises économiques et financières : un point de vue...

Public lecture 1 - Jean-Philippe Bouchaud “Crises économiques et financières : un point de vue de physicien” « The Economic Crisis is a Crisis for Economic Theory » a récemment écrit Alan Kirman. La théorie en question affirme que les agents sont rationnels et les marchés sont « efficien

From playlist T1-2015 : Disordered systems, random spatial processes and some applications

QRM 10-3: The Model Building Approach

This video is taken from by basic RM course and deals with MR under the model-building approach.

From playlist Quantitative Risk Management