Financial Options Pricing History. How do Investors Price Options?

Financial Options Pricing History. Today we will learn How do Investors Price Options? These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patri

From playlist Class 2: An Introduction to Options

What are index options? What are currency options?

In todays video we will learn about options on foreign exchange and index options. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick

From playlist Class 5 - Options Wrap Up

What are Real Options? - Real Options Valuation Method For Capital Budgeting Decisions

Real options valuation, also often termed real options analysis, applies option valuation techniques to capital budgeting decisions. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our

From playlist Class 5 - Options Wrap Up

Options Trading - Call and Put Options - Basic Introduction

This stock options trading video tutorial provides a basic introduction into call and put options. The prices of options depend on share price, volatility, and time left to expiration. The extrinsic value of all options is subject to time decay, that is, they decrease as time move forwar

From playlist Stocks and Bonds

Simple Options Positions - Call Options - Put Options - Long and Short - Beginners Tutorial

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle There is no free lunch with sto

From playlist Class 2: An Introduction to Options

Financial Markets (ECON 252) Options introduce an essential nonlineary into portfolio management. They are contracts between buyers and writers, who agree on exercise prices and dates at which the buyer can buy or sell the underlying (such as a stock). Options are priced based on the pr

From playlist Financial Markets (2008) with Robert Shiller

In todays video we will learn all about Exotic Options. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://t

From playlist Exotic Options & Structured Products

What is an Options Contract in Finance

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle What are Financial Options? Opt

From playlist Class 2: An Introduction to Options

Pricing Options Using the Binomial Tree (Risk Neutral Valuation Approach)

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle In finance, the binomial option

From playlist Class 3: Pricing Financial Options

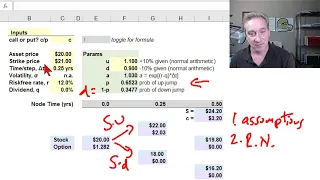

Introduction to binomial option pricing model: two-step (FRM T4-6)

[my xls is here https://trtl.bz/2AruFiH] The binomial option pricing model needs: 1. A set of assumptions similar but not identical to those found in Black-Scholes; 2. A framework; i.e., risk-neutral valuation which allows us to infer the probability of an up-jump; 3. An assumption about a

From playlist Valuation and RIsk Models (FRM Topic 4)

Exotic options: Barrier options (FRM T3-42)

The barrier option adds a barrier value (for example, H = $95.00) and it the option can either "knock-out" (ie, get knocked-out if the barrier is breached) or "knock-in" (ie, come into existence if the barrier is breached. If the barrier is below the asset price, it is either a down-and-ou

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Pricing American Options using the Binomial Tree Method. - Options Trading Classes

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle This is the fifth video in our

From playlist Class 3: Pricing Financial Options

Valuation Approaches & Paradigms Part 1: TEEB@YALE

Valuation approaches & paradigms; Biophysical approaches; the Total Economic Value (TEV) framework & its various valuation methods; acknowledging uncertainties in valuation ; Insurance value and Resilience ; Quasi-Option Values ; Valuation across Stakeholders ; Valuation in developing coun

From playlist TEEB @ Yale

2 - Set up a business and raise the first capital

Lecture II: „How to set-up a business and raise the first capital“ André Eggert, Partner, LACORE Rechtsanwälte (Berlin’s leading Startup Lawyer) & Christophe Maire, CEO & Co-Founder, Atlantic Internet (Berlin‘s leading Seed Investor)

From playlist Startup Talks with Founder of Flixbus, GetYourGuide and GoEuro

Pricing Options - Revision Lecture

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist Revision Lectures

Getting Started with Financial Modeling | Financial Modeling Tutorial | What is Financial Modeling

This Financial Modeling tutorial helps you to learn financial modeling with examples. This video is ideal for beginners to learn the basics of financial modeling. To attend a live session, click here: http://goo.gl/1fclPr This video helps you learn: • Why Financial Modeling ? • Cours

From playlist Financial Modeling Tutorial Videos

Exercising Options - How and why do you exercise an options contract? Put Options and Call options

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle Exercising Options Calls and pu

From playlist Class 2: An Introduction to Options

Exotic options: chooser option (FRM T3-43)

The chooser (aka, as you like it) option has one strike price (K = $40.00 in my example) but two key dates (T1 and T2). On the first date (T1), the holder "chooses" it to be either a call or a put. At that point, it becomes a standard call/put with a remaining life of Δt = T2 - T1. In the

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)