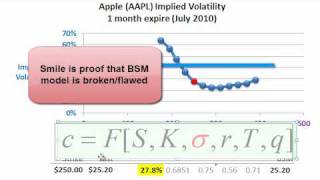

Volatility smile

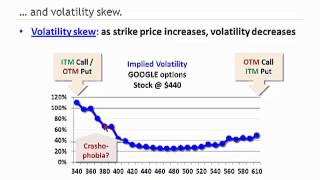

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter (implied volatility) that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration, options whose strike price differs substantially from the underlying asset's price command higher prices (and thus implied volatilities) than what is suggested by standard option pricing models. These options are said to be either deep in-the-money or out-of-the-money. Graphing implied volatilities against strike prices for a given expiry produces a skewed "smile" instead of the expected flat surface. The pattern differs across various markets. Equity options traded in American markets did not show a volatility smile before the Crash of 1987 but began showing one afterwards. It is believed that investor reassessments of the probabilities of fat-tail have led to higher prices for out-of-the-money options. This anomaly implies deficiencies in the standard Black–Scholes option pricing model which assumes constant volatility and log-normal distributions of underlying asset returns. Empirical asset returns distributions, however, tend to exhibit fat-tails (kurtosis) and skew. Modelling the volatility smile is an active area of research in quantitative finance, and better pricing models such as the stochastic volatility model partially address this issue. A related concept is that of term structure of volatility, which describes how (implied) volatility differs for related options with different maturities. An implied volatility surface is a 3-D plot that plots volatility smile and term structure of volatility in a consolidated three-dimensional surface for all options on a given underlying asset. (Wikipedia).