What is the Monte Carlo method? | Monte Carlo Simulation in Finance | Pricing Options

In today's video we learn all about the Monte Carlo Method in Finance. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter h

From playlist Exotic Options & Structured Products

An introduction to multilevel Monte Carlo methods – Michael Giles – ICM2018

Numerical Analysis and Scientific Computing Invited Lecture 15.7 An introduction to multilevel Monte Carlo methods Michael Giles Abstract: In recent years there has been very substantial growth in stochastic modelling in many application areas, and this has led to much greater use of Mon

From playlist Numerical Analysis and Scientific Computing

Monte Carlo Integration In Python For Noobs

Monte Carlo is probably one of the more straightforward methods of numerical Integration. It's not optimal if working with single-variable functions, but nonetheless is easy to use, and readily generalizes to multi-variable functions. In this video I motivate the method, then solve a one-d

From playlist Daily Uploads

(ML 17.3) Monte Carlo approximation

From playlist Machine Learning

Monte Carlo Simulation and Python

Monte Carlo Simulation with Python Playlist: http://www.youtube.com/watch?v=9M_KPXwnrlE&feature=share&list=PLQVvvaa0QuDdhOnp-FnVStDsALpYk2hk0 Here we bring at least the initial batch of tutorials to a close with the 3D plotting of our variables in search for preferable settings to use.

From playlist Monte Carlo Simulation with Python

Lecture 5: Introduction to Monte Carlo in Finance

Lecturer: Prof. Shimon Benninga Tel Aviv University 2.8.11

From playlist Financial Modeling (Simon Benniga)

Robert Tichy: Quasi-Monte Carlo methods and applications: introduction

VIRTUAL LECTURE Recording during the meeting "Quasi-Monte Carlo Methods and Applications " the October 28, 2020 by the Centre International de Rencontres Mathématiques (Marseille, France) Filmmaker: Guillaume Hennenfent Find this video and other talks given by worldwide mathematician

From playlist Virtual Conference

Financial Derivatives - Lecture 8 - Monte Carlo Method & Risk Management

These full length lectures are being provided for students who are unable to attend live university lectures due to the public health issues associated with Covid 19. I will return to my standard YouTube video format shortly. Buy The Book Here: https://amzn.to/2Qdj9zu Visit our website.

From playlist Full Financial Derivatives Lectures

Monte Carlo Simulation For Any Model in Excel - A Step-by-Step Guide

Read more on Monte Carlo Simulations and download a sample model here: https://magnimetrics.com/monte-carlo-simulation-in-financial-modeling/ If you like this video, drop a comment, give it a thumbs up and consider subscribing here: https://www.youtube.com/channel/UCrdjXR70BwWIX--ZtQB42XQ

From playlist Excel Tutorials

Gunther Leobacher: Quasi Monte Carlo Methods and their Applications

In the first part, we briefly recall the theory of stochastic differential equations (SDEs) and present Maruyama's classical theorem on strong convergence of the Euler-Maruyama method, for which both drift and diffusion coefficient of the SDE need to be Lipschitz continuous. VIRTUAL LECTU

From playlist Virtual Conference

Monte Carlo Simulation and Python 18 - 2D charting monte carlo variables

Monte Carlo Simulation with Python Playlist: http://www.youtube.com/watch?v=9M_KPXwnrlE&feature=share&list=PLQVvvaa0QuDdhOnp-FnVStDsALpYk2hk0 Here we use Matplotlib to chart a 2D representation of our variables and their relationship to profit. In the monte carlo simulation with Python

From playlist Monte Carlo Simulation with Python

Gerhard Larcher: Two concrete FinTech applications of QMC

I present the basics and numerical result of two (or three) concrete applications of quasi-Monte-Carlo methods in financial engineering. The applications are in: derivative pricing, in portfolio selection, and in credit risk management. VIRTUAL LECTURE Recording during the meeting "Q

From playlist Virtual Conference

From playlist Contributed talks One World Symposium 2020

Monte Carlo Geometry Processing

Project Page: http://www.cs.cmu.edu/~kmcrane/Projects/MonteCarloGeometryProcessing/index.html

From playlist Research

How to Make Predictions Using Monte Carlo Simulations

Monte Carlo simulations are commonly used for answering probability questions. This video provides an overview of the method, and it gives examples and references relevant resources. With Monte Carlo simulations, you start with a simulation model, run that model many times with randomly c

From playlist “How To” with MATLAB and Simulink

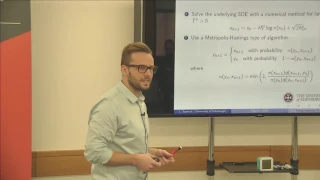

Dr Lukasz Szpruch, University of Edinburgh

Bio I am a Lecturer at the School of Mathematics, University of Edinburgh. Before moving to Scotland I was a Nomura Junior Research Fellow at the Institute of Mathematics, University of Oxford, and a member of Oxford-Man Institute for Quantitative Finance. I hold a Ph.D. in mathematics fr

From playlist Short Talks

Monte Carlo Simulation and Python 1 - Intro

Monte Carlo Simulation with Python Playlist: http://www.youtube.com/watch?v=9M_KPXwnrlE&feature=share&list=PLQVvvaa0QuDdhOnp-FnVStDsALpYk2hk0 In the monte carlo simulation with Python series, we test various betting strategies. A simple 50/50 strategy, a martingale strategy, and the d'ale

From playlist Monte Carlo Simulation with Python