What are Variance Swaps? Financial Derivatives - Trading Volatility

In todays video we learn about variance swaps These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com

From playlist Volatility and Variance Swaps

What are Volatility Swaps? Financial Derivatives - Trading Volatility

In todays class we learn about what a volatility swap is. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https:/

From playlist The Term Structure of Volatility

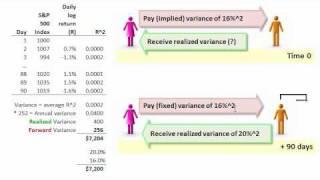

A variance swap can be used to hedge tail risk. One counterparty (Sally the trader, in this example) pays a forward (fixed) variance in exchange for a future, REALIZED variance. So she is "long volatility" and will profit if the realized variance is greater than expected. The advantage of

From playlist Derivatives: Exotic Options

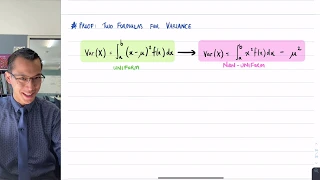

Variance (4 of 4: Proof of two formulas)

More resources available at www.misterwootube.com

From playlist Random Variables

What are Dividend Swaps, commodity swaps, equity swaps?

In todays video we will learn about Dividend Swaps, Commodity Swaps and Equity Swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patri

From playlist Swaps

Covariance (1 of 17) What is Covariance? in Relation to Variance and Correlation

Visit http://ilectureonline.com for more math and science lectures! To donate:a http://www.ilectureonline.com/donate https://www.patreon.com/user?u=3236071 We will learn the difference between the variance and the covariance. A variance (s^2) is a measure of how spread out the numbers of

From playlist COVARIANCE AND VARIANCE

What are Swaps? Financial Derivatives Tutorial

In todays video we learn about Swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/Patrick

From playlist Swaps

Variance on a Modified Distribution (2 of 2: Investigating the modifications)

More resources available at www.misterwootube.com

From playlist Random Variables

In todays video we learn about currency swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.co

From playlist Swaps

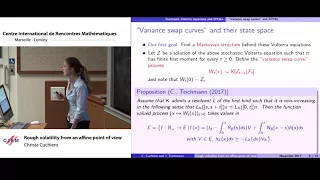

Christa Cuchiero: Rough volatility from an affine point of view

Abstract: We represent Hawkes process and their Volterra long term limits, which have recently been used as rough variance processes, as functionals of infinite dimensional affine Markov processes. The representations lead to several new views on affine Volterra processes considered by Abi

From playlist Probability and Statistics

Financial Derivatives - Lecture 7 - Forward Rate Agreements & Swaps

These full length lectures are being provided for students who are unable to attend live university lectures due to the public health issues associated with Covid 19. I will return to my standard YouTube video format shortly. Buy The Book Here: https://amzn.to/2Qdj9zu Visit our website.

From playlist Full Financial Derivatives Lectures

Quantitative Finance: Toward A General Framework for Modelling Roll-Over Risk

SIAM Activity Group on FME Virtual Talk Series Join us for a series of online talks on topics related to mathematical finance and engineering and running every two weeks until further notice. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Spea

From playlist SIAM Activity Group on FME Virtual Talk Series

Stanford CS229: Machine Learning | Summer 2019 | Lecture 20 - Variational Autoencoder

For more information about Stanford’s Artificial Intelligence professional and graduate programs, visit: https://stanford.io/ai Anand Avati Computer Science, PhD To follow along with the course schedule and syllabus, visit: http://cs229.stanford.edu/syllabus-summer2019.html

From playlist Stanford CS229: Machine Learning Course | Summer 2019 (Anand Avati)

Seventeenth SIAM Activity Group on FME Virtual Talk

Date: Thursday, February 4, 2021, 1PM-2PM Speaker: Carol Alexander, University Sussex Title: Trading and Hedging Bitcoin Volatility Abstract: This talk is in three sections. It starts with a general overview of crypto asset markets, focussing on data complexities and the trading behavio

From playlist SIAM Activity Group on FME Virtual Talk Series

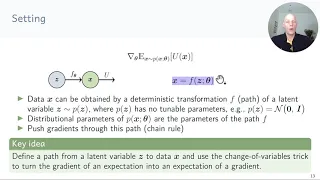

12 Stochastic Gradient Estimators

Slides and more information: https://mml-book.github.io/slopes-expectations.html

From playlist There and Back Again: A Tale of Slopes and Expectations (NeurIPS-2020 Tutorial)

Derivations.2.Derivation of Variance

This video is brought to you by the Quantitative Analysis Institute at Wellesley College. The material is best viewed as part of the online resources that organize the content and include questions for checking understanding: https://www.wellesley.edu/qai/onlineresources

From playlist Optional - Derivations

Options, Options, and Options: An Introduction with a Real Pro

Options, Options, and Options: An Introduction with a Real Pro My good friend Carey Duryea gives a really solid talk on options. Carey is an actual successful real life options trader. I hope you guys enjoy this video. If you like this video please leave a comment below and don't forget

From playlist Finance