What is Implied Volatility? Options Trading Tutorial.

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist The Term Structure of Volatility

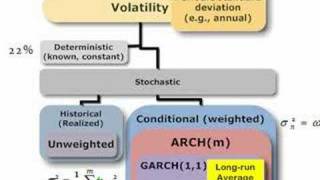

Lots of ways to estimate volatility. In this map, I parse out implied volatility (forward looking) and deterministic (constant) and focus on stochastic volatility: volatility that changes over time, either via (conditional) recent volatility and/or random shocks. For more financial risk vi

From playlist Volatility

Risk Management Lesson 4A: Volatility

First part of Lesson 4. Topics: - Definitions of volatility - Basic assumptions (do they hold?) - Arch and G-arch models (brief overview)

From playlist Risk Management

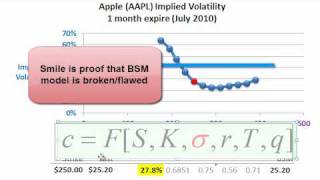

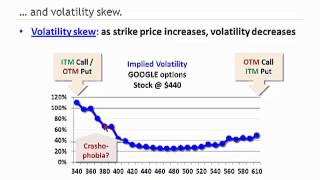

A plot of implied volatility (i.e., the volatility that forces the BSM model option price to equal the observed market price) against strike price. The smile is proof the model is imprecise (incorrect in some assumption); e.g., returns are not lognormally distributed. For more financial ri

From playlist Volatility

Fin Math L6-3: Implied Volatility and Wang Transforms

This is the third part of Lesson 6. We continue the discussion about the estimation of volatility in the BSM framework, by dealing with implied volatility. After that, we start analysing the "distortions" we induce by moving from P to Q, and we also introduce a new measure D. Topics: 00:0

From playlist Financial Mathematics

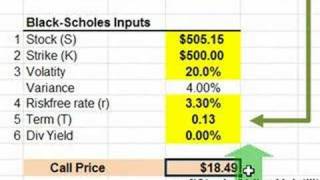

Using the market price for an option on Google's stock, I use Excel's GOAL SEEK function to estimate implied volatility. Implied volatility is a reverse-engineering exercise: we find the volatility that produces a MODEL VALUE = MARKET PRICE. For more financial risk videos, visit our websit

From playlist Volatility

The Volatility Smile - Options Trading Lessons

The volatility smile is a real-life pattern that is observed when different strikes of option, with the same underlying and same expiration date are plotted on a graph. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. htt

From playlist The Term Structure of Volatility

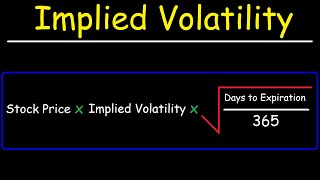

Implied Volatility & Expected Range Using Confidence Levels - Options Trading Concepts

This options trading video provides a basic introduction on implied volatility and how it affects the prices of options. It also describes how to use IV to calculate a stock's expected trading range within a given time period at a 68% confidence level. Long Call Options Trading Strategy:

From playlist Stocks and Bonds

The Term Structure of Volatility and the Volatility Surface

Today we will learn about the volatility Surface. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter

From playlist The Term Structure of Volatility

Volatility Arbitrage - How does it work? - Options Trading Lessons

What is Volatility Arbitrage? Volatility arbitrage is a trading strategy that attempts to profit from the difference between the forecasted price-volatility of an asset, like a stock, and the implied volatility of options on that asset. These classes are all based on the book Trading and

From playlist Class 4 The Greeks & Dynamic Hedging

Volatility Trading - Call and Put Options - Trading Tutorial

These classes are all based on the book Derivatives For The Trading Floor, available on Amazon at this link. https://amzn.to/3GdLi2s Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle What is volatility trading? Volatility

From playlist Class 4 The Greeks & Dynamic Hedging

2012 FRM Market Risk Measurement & Management T5.a

This is a sample of our 2012 FRM Market Risk Measurement & Management T5.a video tutorials. You may view our products here: https://www.bionicturtle.com/products/financial-risk-management/ The Bionic Turtle program is the most effective and affordable preparation aid for the Financial Ri

From playlist FRM

The Volatility Surface and Exotics - Revision Lecture

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist Revision Lectures

The Option Greeks and Hedging - Revision Lecture

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist Revision Lectures