What is the Monte Carlo method? | Monte Carlo Simulation in Finance | Pricing Options

In today's video we learn all about the Monte Carlo Method in Finance. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter h

From playlist Exotic Options & Structured Products

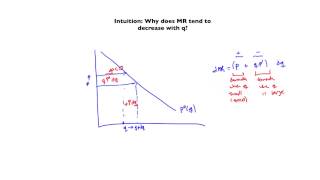

Understanding How Prices Work in a Free Market

Now that we know about supply and demand, we are ready to talk about prices, and how they dictate the dynamics of a free market economy. Free markets lead to an efficient distribution of resources, however there are exceptions, such as with imperfect competition and monopolies, so let's ma

From playlist Economics

What are index options? What are currency options?

In todays video we will learn about options on foreign exchange and index options. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick

From playlist Class 5 - Options Wrap Up

Unit 7 - no price discrimination part 1

From playlist Courses and Series

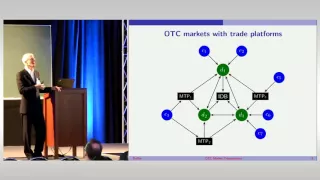

Panorama of Mathematics: Darrell Duffie

Panorama of Mathematics To celebrate the tenth year of successful progression of our cluster of excellence we organized the conference "Panorama of Mathematics" from October 21-23, 2015. It outlined new trends, results, and challenges in mathematical sciences. Darrell Duffie: "Price Tran

From playlist Panorama of Mathematics

Valuation of plain-vanilla interest rate swap (T3-32)

[here is my XLS https://trtl.bz/2Q4XFCh] I breakdown the valuation of an interest rate swap into three steps: 1. The assumptions, which includes understanding the TIMELINE; e.g., we are valuing the stop at some point after origination and it has some remaining life (in this case 15 months)

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

Pareto Analysis for Beginners in Excel

Check out the article on Pareto Analysis and download the Excel file here: https://magnimetrics.com/pareto-principle-in-financial-analysis/ Fill our survey for a FREE Benchmark Analysis template! https://forms.gle/A4MLhr7J5rRG1JBi8 If you like this video, drop a comment, give it a thumbs

From playlist Excel Tutorials

Redesigning over-the-counter financial markets 2/2

Darrell Duffie Stanford University, USA

From playlist Distinguished Visitors Lecture Series

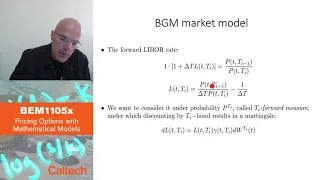

10 9 Forward rates models Part 3

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Swaps and The Law of Comparative Advantage - How to do the comparative advantage swap calculation.

In todays video we learn about how Swap participants benefit from the law of comparative advantage. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/

From playlist Swaps

In this video, you’ll learn more about the sharing economy. Visit https://www.gcflearnfree.org/using-the-web-to-get-stuff-done/what-is-the-sharing-economy/1/ for our text-based lesson. This video includes information on: • An explanation of the sharing economy • Examples of the sharing ec

From playlist The Sharing Economy

Redesigning over-the-counter financial markets 1/2

Distinguished Visitor Lecture Series Redesigning over-the-counter financial markets Darrell Duffie Stanford University, USA

From playlist Distinguished Visitors Lecture Series

Webinar: If I build it, will they come? Understanding Product-Market Fit

Learn more at: https://stanford.io/370yNcZ So your company has a product idea. How do you know if this product is worth building? Will there be a demand for it? Enter: product-market fit. Put simply, product-market fit means that there are enough people out there who will buy what your c

From playlist Leadership & Management

Quantitative Finance: Toward A General Framework for Modelling Roll-Over Risk

SIAM Activity Group on FME Virtual Talk Series Join us for a series of online talks on topics related to mathematical finance and engineering and running every two weeks until further notice. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Spea

From playlist SIAM Activity Group on FME Virtual Talk Series

Saul Levmore: Monopolies as an Introduction to Economics | Big Think

Saul Levmore: Monopolies as an Introduction to Economics Watch the newest video from Big Think: https://bigth.ink/NewVideo Join Big Think Edge for exclusive videos: https://bigth.ink/Edge ---------------------------------------------------------------------------------- Levmore brings the

From playlist The Floating University Sessions | Big Think

What is a Credit Default Swap? | CDS | Credit Derivatives

In todays video we learn about Credit Default Swaps - Credit Derivatives. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitte

From playlist Swaps

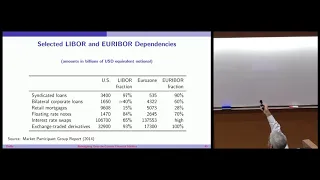

Eurodollar futures contract (FRM T3-28)

[my xls is here https://trtl.bz/2O6m5ea] A Eurodollar (ED) futures contract is an interest rate derivative: it references a future three-month LIBOR interest rate. The futures quote is given by Q = 100 - R, where R is LIBOR; for example, a ED futures quote of 97.00 signifies an anticipated

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

From playlist Courses and Series

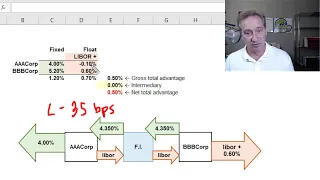

Comparative advantage in an interest rate swap (FRM T3-31)

[my xls is here https://trtl.bz/2DceGc6] AAACorp has a comparative advantage in fixed-rate markets, but BBBCorp has a comparative advantage in floating-rate markets (even as it pays more everwhere!). The difference in spreads (in this case, the difference is 0.50% = 1.20% - 0.70%) is the g

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)