QRM L1-1: The Definition of Risk

Welcome to Quantitative Risk Management (QRM). In this first class, we define what risk if for us. We will discuss the basic characteristics of risk, underlining some important facts, like its subjectivity, and the impossibility of separating payoffs and probabilities. Understanding the d

From playlist Quantitative Risk Management

Welcome to Quantitative Risk Management (QRM). In this lesson we introduce the axiomatic approach to risk measures. We give the definition of risk measure and we discuss what its uses for us are in terms of reserve capital quantification. We then define coherent and convex measures. The p

From playlist Quantitative Risk Management

QRM L1-2: The dimensions of risk and friends

Welcome to Quantitative Risk Management (QRM). In this second video, we analyse the dimensions of risk. Risk is in fact an object that we need to consider from different points of view, and that sometimes we cannot even quantify. We will also discuss the importance of statistical thinking

From playlist Quantitative Risk Management

What is Value at Risk? VaR and Risk Management

In todays video we learn about Value at Risk (VaR) and how is it calculated? Buy The Book Here: https://amzn.to/37HIdEB Follow Patrick on Twitter Here: https://twitter.com/PatrickEBoyle What Is Value at Risk (VaR)? Value at risk (VaR) is a calculation that aims to quantify the level of

From playlist Risk Management

Risk Management Lesson 5A: Value at Risk

In this first part of Lesson 5, we discuss Value-at-Risk (VaR). Topics: - Definition of VaR - Loss distribution and confidence level - The normal VaR

From playlist Risk Management

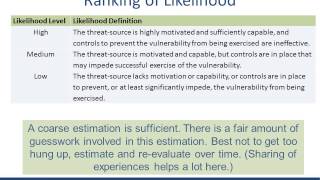

Risk Assessment: Likelihood Determination

http://trustedci.org/ Determining Likelihood of a threat as part of a cyber risk assessment.

From playlist Center for Applied Cybersecurity Research (CACR)

Risk Management Lesson 4A: Volatility

First part of Lesson 4. Topics: - Definitions of volatility - Basic assumptions (do they hold?) - Arch and G-arch models (brief overview)

From playlist Risk Management

FRM: Parametric value at risk (VaR): Pros & Cons

Here is a quick explanation of parametric value at risk (VaR) as a means to illustrating its strengths/weaknesses. Please note: The essence of parametric VaR is "no data:" while historical data is surely used to select a distribution and calibrate its parameters, a parametric VaR leans on

From playlist Value at Risk (VaR): Introduction

FinMath L3-2: Risk-neutral measures and self-financing portfolios

Welcome to Lesson 3 of Financial Mathematics (Part 2). In this second half of the lesson, we discuss important topics like self-financing portfolio, risk neutral measures and their basic properties, and the concept of arbitrage. All these tools are essential in financial mathematics, and t

From playlist Financial Mathematics

Fin Math L6-1: The Black-Scholes-Merton theorem

Welcome to Lesson 6 of Financial Mathematics. This is the lesson of the Black-Scholes-Merton (BSM) theorem. Finally, you might say. But it will also be the lesson of volatility and distortions. A lot of interesting things. In this first video, we focus on the BSM theorem. Topics: 00:00 I

From playlist Financial Mathematics

Fin Math L5-2: A simple exchange rate model

In this second part of Lesson 5, we consider a simple exchange rate model, which allows us to see the Cameron-Martin theorem in action. The model also introduces a particular version of the exponential martingale that will be essential for us later. I ask you to spend some time reasoning a

From playlist Financial Mathematics

Fin Math L4-2: The two fundamental theorems of asset pricing and the exponential martingale

Welcome to the second part of Lesson 4 of Financial Mathematics. In this video we discuss the two fundamental theorems of asset pricing and we introduce the exponential martingale, an essential tool that we will use as the Radon-Nikodym derivative to move from P to Q in the Cameron-Martin

From playlist Financial Mathematics

What's the main mistake that risk managers are making with conduct risk and compliance?

Peter Tyson, Head Of Conduct & Compliance, Standard Life, explains the key mistakes that risk managers are making with conduct and compliance at RiskMinds Insurance 2016.

From playlist Insurance risk: Predict risk in an unpredictable world

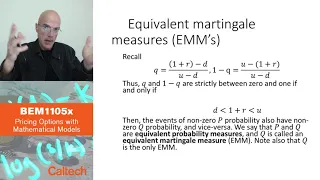

4 5 Fundamental theorems of asset pricing Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Fin Math L4-1: Change of measure and the Radon-Nikodym derivative

Welcome to Lesson 4 of Financial Mathematics. In this first part of our lesson we deal with the change of measure, a fundamental operation to guarantee the possibility of finding a proper risk-neutral measure. We therefore introduce Radon-Nikodym derivatives and other related concepts. To

From playlist Financial Mathematics

QRM 10-1: The Greeks for Market Risk

Lesson 10 is devoted to the model building approach to market risk. To use such an approach, we need some basic tools from financial mathematics and basic risk management, an example being the Greeks and duration (which nevertheless is linked to the Greeks). For those of you who are not fa

From playlist Quantitative Risk Management

19. Black-Scholes Formula, Risk-neutral Valuation

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013 View the complete course: http://ocw.mit.edu/18-S096F13 Instructor: Vasily Strela This is a lecture on risk-neutral pricing, featuring the Black-Scholes formula and risk-neutral valuation. License: Creative Commons

From playlist MIT 18.S096 Topics in Mathematics w Applications in Finance

How do you calculate value at risk? Two ways of calculating VaR

In todays video we learn how to calculate VaR or Value at Risk. Buy The Book Here: https://amzn.to/37HIdEB Follow Patrick on Twitter Here: https://twitter.com/PatrickEBoyle What is VAR? The most popular and traditional measure of risk is volatility. The main problem with volatility, how

From playlist Risk Management

Fin Math L7: The Wang transform and the Lorenz curve in Black-Scholes-Merton

Welcome to Financial Mathematics. In this lesson we continue our discussion about the Wang transform and we also introduce an interesting connection with the Lorenz curve, a very useful instrument originally developed in the inequality studies' literature. As we shall see, the use of Wang

From playlist Financial Mathematics