Pricing Options Using the Binomial Tree (Risk Neutral Valuation Approach)

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle In finance, the binomial option

From playlist Class 3: Pricing Financial Options

Financial Options Pricing History. How do Investors Price Options?

Financial Options Pricing History. Today we will learn How do Investors Price Options? These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patri

From playlist Class 2: An Introduction to Options

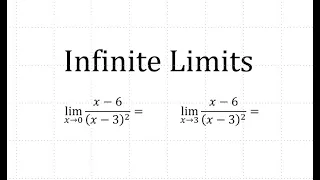

Determine Infinite Limits of a Rational Function Using a Table and Graph (Squared Denominator)

This video explains how to determine a limits and one-sided limits. The results are verified using a table and a graph.

From playlist Infinite Limits

Financial Option Theory with Mathematica -- Volatility, and direct solution of PDEs

This is my third session of my track about Financial Option Theory with Mathematica. I first develop two methods to compute historical volatility of a stock. Next I do the same for an estimate of the historical appreciation rate. I then come to the very important topic of the implied volat

From playlist Financial Options Theory with Mathematica

What are Real Options? - Real Options Valuation Method For Capital Budgeting Decisions

Real options valuation, also often termed real options analysis, applies option valuation techniques to capital budgeting decisions. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our

From playlist Class 5 - Options Wrap Up

Lec 14 | MIT 18.086 Mathematical Methods for Engineers II

Financial Mathematics / Black-Scholes Equation View the complete course at: http://ocw.mit.edu/18-086S06 License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 18.086 Mathematical Methods for Engineers II, Spring '06

Giray Ökten: Derivative pricing, simulation from non-uniform distributions - lecture 3

The models of Bachelier and Samuelson will be introduced. Methods for generating number sequences from non-uniform distributions, such as inverse transformation and acceptance rejection, as well as generation of stochastic processes will be discussed. Applications to pricing options via re

From playlist Probability and Statistics

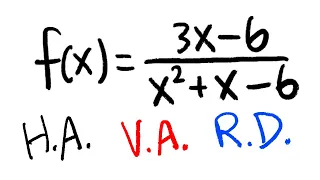

Horizontal Asymptote, Vertical Asymptote, & Removable Discontinuity

How to find the Horizontal asymptote, vertical asymptote and removable discontinuity from a rational function. #calculus For more similar examples, check out my playlist :https://www.youtube.com/playlist?list=PLb2SZv7eAqpmFSRhJAtPYis3RT2TtCWbl Horizontal Asymptote, @0:10 Vertical Asymptot

From playlist Limits at Infinities, (sect 2.6)

Nash Equilibriums // How to use Game Theory to render your opponents indifferent

Check out Brilliant ► https://brilliant.org/TreforBazett/ Join for free and the first 200 subscribers get 20% off an annual premium subscription. Thank you to Brilliant for sponsoring this playlist on Game Theory. Game Theory Playlist ► https://www.youtube.com/playlist?list=PLHXZ9OQGMqx

From playlist Game Theory

Gunther Leobacher: Quasi Monte Carlo Methods and their Applications

In the first part, we briefly recall the theory of stochastic differential equations (SDEs) and present Maruyama's classical theorem on strong convergence of the Euler-Maruyama method, for which both drift and diffusion coefficient of the SDE need to be Lipschitz continuous. VIRTUAL LECTU

From playlist Virtual Conference

Asymptotic properties of the volatility estimator from high-frequency data modeled by Ananya Lahiri

Large deviation theory in statistical physics: Recent advances and future challenges DATE: 14 August 2017 to 13 October 2017 VENUE: Madhava Lecture Hall, ICTS, Bengaluru Large deviation theory made its way into statistical physics as a mathematical framework for studying equilibrium syst

From playlist Large deviation theory in statistical physics: Recent advances and future challenges

#5 Limit orders as makers | Trading on Coinbase Pro - GDAX

In this video, let's look at the next two limit order configurations. We are ready to move to the buy-buy and the sell-sell permutations. With these two configurations, we will see how makers come to be. Since the order side and the limit price are on the same side, these particular config

From playlist Trading - Advanced Order Types with Coinbase

Epsilon delta limit (Example 3): Infinite limit at a point

This is the continuation of the epsilon-delta series! You can find Examples 1 and 2 on blackpenredpen's channel. Here I use an epsilon-delta argument to calculate an infinite limit, and at the same time I'm showing you how to calculate a right-hand-side limit. Enjoy!

From playlist Calculus

6 6 Black Scholes Merton pricing Part 3

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Entropic Optimal Transport - Prof. Marcel Nutz

A workshop to commemorate the centenary of publication of Frank Knight’s "Risk, Uncertainty, and Profit" and John Maynard Keynes’ “A Treatise on Probability” This workshop is organised by the University of Oxford and supported by The Alan Turing Institute. For further details and regular

From playlist Uncertainty and Risk

George Papanicolaou: Stochastic Analysis in Finance

This lecture was held at The University of Oslo, May 24, 2007 and was part of the Abel Prize Lectures in connection with the Abel Prize Week celebrations. Program for the Abel Lectures 2007 1. “A Short History of Large Deviations” by Srinivasa Varadhan, Abel Laureate 2007, Courant Ins

From playlist Abel Lectures

Determine a Limit of a Difference of Rational Functions Algebraically: LCD and Rationalize

This video explains how to determine a limit of a difference of rational functions algebraically using LCD and rationalizing.

From playlist Limits

Pricing Options Using Multi Step Binomial Trees

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle The ideas we developed for a si

From playlist Class 3: Pricing Financial Options