In todays video we will learn all about Exotic Options. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://t

From playlist Exotic Options & Structured Products

Financial Derivatives - Class 10 - Exotics, Structured Products & Derivatives Mishaps

An exotic option is an option which has features making it more complex than commonly traded vanilla options. They may have several triggers relating to determination of payoff. An exotic option may also include non-standard underlying instrument, developed for a particular client or for a

From playlist Full Financial Derivatives Lectures

Instead of a fixed strike price, an exchange option gives the holder the right to purchase an asset (denoted V in screencast) with another asset (denoted U). Examples include exchange one currency for another; Executive stock options indexed to S&P500. For more financial risk videos, visit

From playlist Derivatives: Exotic Options

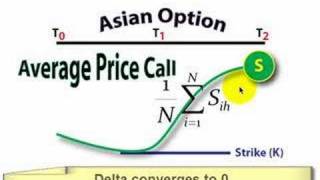

Exotic options: Asian option (FRM T3-46)

[my xls is here https://trtl.bz/2Av3F1Y] Asian options are path-dependent: their value depends on the average of the stock price during the life of the option. There are two basic variations: an average price option pays the difference between the average stock price and the exercise price

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Asian options have terrific advantages over plain-vanilla options. Because an AVERAGE spot/strike price is used: (1) the option is less volatile which makes it cheaper, and (2) it offers less basis risk if the option is used to hedge

From playlist Derivatives: Exotic Options

Relative to plain vanilla options, barrier options have an additional feature: c(S,K, H, volatility, T, r) where H is the barrier. The barrier either knocks-in the option (into existence) or knocks-out (out of existence) the option. Due to this "optionality on the option" the barrier is ch

From playlist Derivatives: Exotic Options

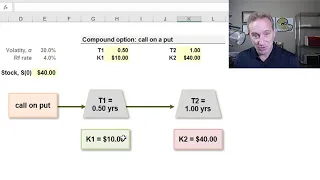

Compound stock option (exotic)

A compound option has two strike prices (K1, K2). The first exercise triggers ownership of a option, not the asset. Four variations: call on a call, call on a put, put on a call, put on a put.

From playlist Derivatives: Exotic Options

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

What is the Monte Carlo method? | Monte Carlo Simulation in Finance | Pricing Options

In today's video we learn all about the Monte Carlo Method in Finance. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter h

From playlist Exotic Options & Structured Products

The Volatility Surface and Exotics - Revision Lecture

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist Revision Lectures

Exotic options: binary (aka, digital) option (FRM T3-44)

A binary (aka, digital) option can be either an asset-or-nothing binary or a cash-or-nothing. The asset-or-nothing call pays the full asset price if the stock price exceeds the strike price at maturity; the cash-or-nothing call pays a fixed cash amount, denoted "Q," if the stock price exce

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Exotic option: exchange option (FRM T3-47)

[my xls is here https://trtl.bz/2C9PEXC] Instead of a fixed exercise price, an exchange option has an exercise price linked to some other asset. In my illustrated example here, the exchange option holder will pay (as the exercise price) 80X the price of silver in exchange for receiving one

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Exotic options: compound option (e.g., call on a call) FRM T3-41

A compound option is an option to buy or sell a call or a put. A call on a call is the right to buy a call at T1 for K1 (and if exercised, the purchased call has a strike of K2 and expires at T2). A call on a put is the right to buy a put at T1 for K1 (and if exercised, the purchased put h

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Exotic options: chooser option (FRM T3-43)

The chooser (aka, as you like it) option has one strike price (K = $40.00 in my example) but two key dates (T1 and T2). On the first date (T1), the holder "chooses" it to be either a call or a put. At that point, it becomes a standard call/put with a remaining life of Δt = T2 - T1. In the

From playlist FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

1 6 Call and Put Options Part I

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić