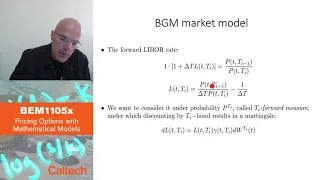

10 9 Forward rates models Part 3

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

What is a Forward Contract? In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or to sell an asset at a specified future time at a price agreed upon today. The party agreeing to buy the underlying asset in the future assumes a long

From playlist Class 1 Futures & Forwards

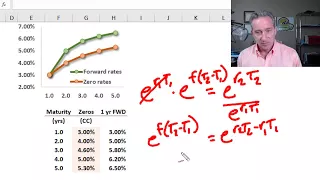

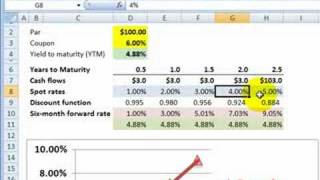

FRM: Calculate forward given spot rate

Given a 2.0 year spot and a 1.5 year spot, we want to solve for the six month forward staring in 1.5 years. That's the forward rate denoted by 1f3 or 0.5f1.5. For more financial risk management videos, visit our website! http://www.bionicturtle.com.

From playlist Bonds: Introduction

10 7 Forward rates models Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Average velocity vs. average speed

Average velocity vs. average speed

From playlist Sect 3.7, Applications of derivative, (rate of change)

From playlist a. Numbers and Measurement

Describes what acceleration is in physics, how to calculate acceleration and how to determine if an object is speeding up, slowing down or moving at a constant velocity based on the direction of it velocity and acceleration vectors You can see a listing of all my videos at my website, http

From playlist Motion Graphs; Position and Velocity vs. Time

Forward rate agreement, FRA (FRM T3-12)

[my xls is here https://trtl.bz/2Hueqmq] A forward rate agreement (FRA) is a loan that starts in the future ("forward start loan") but where principal is not lent; instead, the notional is referenced to determine the interest paid. The FRA contract specifies a fixed rate of interest. The s

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

Forward rates are implied by zero rates (FRM T3-11)

[my xls is here https://trtl.bz/2HMQkUU] Forward rates link two zero (aka, spot) rates by ensuring your expected return is the same between two choices: (1) invest at the longer-term spot rate versus (2) invest at the shorter-term spot rate and "roll over" into the implied forward rate. Th

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

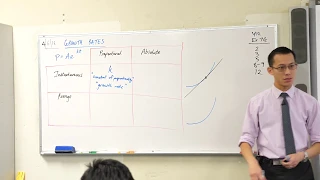

Exponential Growth Rates (1 of 2: Instantaneous)

More resources available at www.misterwootube.com

From playlist Rates of Change

Fixed Income: Term Structure Scenarios (FRM T4-30)

Financial Risk Manager (FRM, Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 3, Returns, Spreads and Yields). The three basic term structure scenarios are: 1. Realized Forwards; 2. Unchanged Term Structure, and 3. Unchanged Yields. Realized Forwards implicitly assum

From playlist Valuation and RIsk Models (FRM Topic 4)

FRM: Comparison of spot curve, forward curve and bond yield

A simple comparison using a 2.5 year $100 par 6% semiannual coupon bond. Spot rate: the yield for each cash flow that treats the cash flow as a zero-coupon bond. A coupon-paying bond is a set of zero-coupon bonds. Forward rate: the implied forward rates that make an investor indifferent to

From playlist Bonds: Introduction

Fixed Income: Infer discount factors, spot, forwards and par rates from swap rate curve (FRM T4-25)

Financial Risk Manager (FRM, Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 2, Spot, Forward and Par Rates). Given the swap rate curve, we can infer the discount function (i.e., set of discount factors), spot rate curve, forward rate curve and par yield curve. Disc

From playlist Valuation and RIsk Models (FRM Topic 4)

Fixed income: Carry roll down (FRM T4-31)

Financial Risk Manager (FRM, Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 3, Returns, Spreads and Yields). The Carry-Roll-Down is the price change in the bond due exclusively to the passage of time. It is only one component of a bond's total profit and loss (P&L)

From playlist Valuation and RIsk Models (FRM Topic 4)

Implied forward rate under continuous compounding

Given two spot rates (e.g., 2 year and 1.5 year) we can infer the market implied forward rate (the six month rate in 1.5 years). Shown under discrete (semiannual) and continuous compounding.

From playlist Bonds: Introduction

MIT RES.TLL-004 Concept Vignettes View the complete course: http://ocw.mit.edu/RES-TLL-004F13 Instructor: George Zaidan In this video, Lego® molecules are used to visualize the ideas that reactions are reversible, reaction rates change with time, and at equilibrium, the rate of the forwar

From playlist MIT STEM Concept Videos