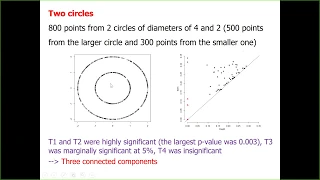

Sarit Agami (3/5/19): Modeling and replicating persistence diagrams

Title: Modeling and replicating persistence diagrams Abstract: Persistence diagrams are useful displays that give summary information about the topological features of some phenomenon. Usually, only one persistence diagram is available, and replicated persistence diagrams are needed for s

From playlist AATRN 2019

Titus van Erp (10/7/22): Exchanging replicas with unequal cost, infinitely and permanently

We developed a replica exchange method that is effectively parallelizable even if the computational cost of the Monte Carlo moves in the parallel replicas are considerably different, for instance, because the replicas run on different type of processor units or because of the algorithmic c

From playlist AATRN/STMS

Can You Validate These Emails?

Email Validation is a procedure that verifies if an email address is deliverable and valid. Can you validate these emails?

From playlist Fun

Ramil Mouad - Parallel Replica algorithm for Langevin dynamics and Adaptative Metadynamics

Recorded 28 March 2023. Ramil Mouad of Seoul National University presents "Parallel Replica algorithm for Langevin dynamics and Adaptative Metadynamics" at IPAM's Increasing the Length, Time, and Accuracy of Materials Modeling Using Exascale Computing workshop. Abstract: This talk will be

From playlist 2023 Increasing the Length, Time, and Accuracy of Materials Modeling Using Exascale Computing

Discrete Math - 8.1.1 Modeling with Recurrence Relations

Modeling some of the famous combinatoric questions (Tower of Hanoi, Fibonacci) with recurrence relations. Textbook: Rosen, Discrete Mathematics and Its Applications, 7e Playlist: https://www.youtube.com/playlist?list=PLl-gb0E4MII28GykmtuBXNUNoej-vY5Rz

From playlist Discrete Math I (Entire Course)

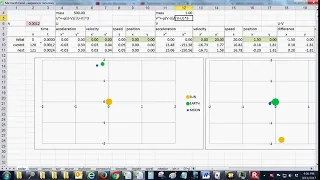

Monte Carlo Simulation For Any Model in Excel - A Step-by-Step Guide

Read more on Monte Carlo Simulations and download a sample model here: https://magnimetrics.com/monte-carlo-simulation-in-financial-modeling/ If you like this video, drop a comment, give it a thumbs up and consider subscribing here: https://www.youtube.com/channel/UCrdjXR70BwWIX--ZtQB42XQ

From playlist Excel Tutorials

Replica Set in MondoDB | MongoDB Tutorial

🔥Full Stack Developer - MEAN Stack:https://www.simplilearn.com/full-stack-web-developer-mean-stack-certification-trainingg?utm_campaign=ReplicasetinMongoDB-PqQuShYSzBU&utm_medium=DescriptionFF&utm_source=youtube 🔥Caltech Coding Bootcamp (US Only): https://www.simplilearn.com/coding-bootcam

From playlist MongoDB Tutorial Videos [2022 Updated]

What are the different ways to perform data validation in machine learning?

#machinelearning #shorts #datascience

From playlist Quick Machine Learning Concepts

A solar system, a simulation made with Excel

An Excel simulation of the solar system. You can see how things are recursively computed: the mutual gravity force from the locations, the accelerations, the velocities, and finally the updated locations. The solar eclipse is also shown. This is clip is intended to illustrate Chapter 24 Ap

From playlist Physics simulations

Fixed Income: Arbitrage to exploit violation of law of one price (FRM T4-24)

Financial Risk Manager (FRM), Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 1, Prices Discount Factors and Arbitrage. How do we exploit the Law of One Price (which asserts that--absent confounding factors like liquidity or taxes--is only one set of discount factor

From playlist Valuation and RIsk Models (FRM Topic 4)

Dynamic Hedging of Options - Option Trading Strategies

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle What is Dynamic Hedging? A hedg

From playlist Class 4 The Greeks & Dynamic Hedging

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

FRM: Intuition behind the Black-Scholes-Merton

The value of a European call must be equal to a replicating portfolio that has two positions: long a fractional (delta) share of stock plus short a bond (where the bond = strike price). For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Derivatives: Option Pricing

9 8 Hedging portfolio sensitivities Part 3

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

6 2 Black Scholes Merton pricing Part 2

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

19. Black-Scholes Formula, Risk-neutral Valuation

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013 View the complete course: http://ocw.mit.edu/18-S096F13 Instructor: Vasily Strela This is a lecture on risk-neutral pricing, featuring the Black-Scholes formula and risk-neutral valuation. License: Creative Commons

From playlist MIT 18.S096 Topics in Mathematics w Applications in Finance

Fin Math L6-1: The Black-Scholes-Merton theorem

Welcome to Lesson 6 of Financial Mathematics. This is the lesson of the Black-Scholes-Merton (BSM) theorem. Finally, you might say. But it will also be the lesson of volatility and distortions. A lot of interesting things. In this first video, we focus on the BSM theorem. Topics: 00:00 I

From playlist Financial Mathematics

Inaugural SIAM Activity Group on FME Virtual Talk

This is the first in a series of online talks on topics related to mathematical finance and engineering. The series is organized by the SIAM Activity Group on Financial Mathematics and Engineering. Title: Trading with impact Abstract: It is well known that large trades cause unfavorable p

From playlist SIAM Activity Group on FME Virtual Talk Series

9 4 Perfect hedging replication Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Part 1 Updated version: https://youtu.be/xb5fjOsLzXc This is SoME1 submission version. License: CC BY-NC-SA 2.0

From playlist Summer of Math Exposition Youtube Videos