Mod-07 Lec-18 Financial Statements Analysis - Dabur India Case

Managerial Accounting by Dr. Varadraj Bapat,Department of Management,IIT Bombay.For more details on NPTEL visit http://nptel.ac.in

From playlist IIT Bombay: Managerial Accounting | CosmoLearning.org Accounting

This video defines a ratio and provides several examples on how to write a ratio and shows how to simplify a ratio. http://mathispower4u.wordpress.com/

From playlist Ratios and Rates

Ratios Introduction - what are ratios?

Ratios are used to compare different quantities. In this introduction to ratios we will look at what ratios are, how we deal with ratios of different measurement units and that ratios can be simplified. To donate to the tecmath channel:https://paypal.me/tecmath To support tecmath on Pa

From playlist Ratios

This video introduces the Golden ratio and provides several examples of where the Golden ratio appears. http:mathispower4u.com

From playlist Mathematics General Interest

Liquidity Ratios - Current Ratio and Quick Ratio (Acid Test Ratio)

This finance video tutorial provides a basic introduction into two liquidity ratios - the current ratio and the quick ratio also known as the acid test ratio. The current ratio is equal to the current assets divided by the current liabilities. A current ratio that is greater than 1 means

From playlist Stocks and Bonds

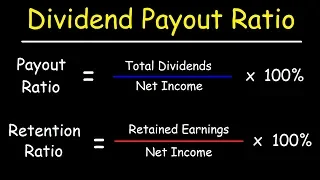

Dividends - Payout Ratio vs Retention Ratio

This stocks and bonds video tutorial explains how to calculate the dividend payout ratio and the retention ratio. The payout ratio is equal to the total dividends paid divided by the net income. The retention ratio is equal to the earnings retained divided by the net income. My Website:

From playlist Stocks and Bonds

Excel Finance Class 14: Financial Statement Ratio Analysis - #1 Trick For Ratio Analysis

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch03.xls Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/BUSN233cH03-16PAGES.pdf Download 2nd Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch03DaysInCashC

From playlist Excel Accounting Playlist Of Videos

Managerial Accounting by Dr. Varadraj Bapat,Department of Management,IIT Bombay.For more details on NPTEL visit http://nptel.ac.in

From playlist IIT Bombay: Managerial Accounting | CosmoLearning.org Accounting

The information ratio is active (or residual) return divided by active (or residual) risk. Active risk is also called tracking error, so the "active information ratio" is given by (active return)/(tracking error). Alternatively, a more technical approach is to use alpha (aka, residual risk

From playlist Risk Foundations (FRM Topic 1)

Valuation Modelling | Financial Modelling Training | Financial Modelling Tutorial | Simplilearn

🔥 Explore Best Courses By Simplilearn: https://www.simplilearn.com/?utm_campaign=ValuationModeling-y0t4uw0FWI4&utm_medium=DescriptionFirstFold&utm_source=youtube Basic valuation techniques are as follows 1. Past performance: Past performance informs us on the historical average level of t

From playlist Microsoft Excel Tutorial Videos 🔥[2022 Updated]

Excel Finance Class 20: Growth Ratios and Market Value Ratios

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch03.xls Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/BUSN233cH03-16PAGES.pdf Download 2nd Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch03DaysInCashC

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

The F ratio is a test of overall significance in a multivariate regression (FRM T2-20)

[here is my xls https://trtl.bz/2HC3OWN] The F ratio is given by (ESS/df)/(RSS/df) and can be used to test the significance of the overall regression; or the significance of the multiple R-squared. Discuss this video here in our forum: https://trtl.bz/2wcGpmS Subscribe here https://www.yo

From playlist Quantitative Analysis (FRM Topic 2)

RAPMs: Treynor, Jensen's, Sharpe (FRM T1-10)

Risk-adjusted performance measures (RAPMs) include Treynor and Jensen's, both of which are functions of the CAPM/SML, and the Sharpe ratio, which can be understood in the context of the CML. [Here is my the spreadsheet I used for this video, please let me know if you have any questions htt

From playlist Risk Foundations (FRM Topic 1)

Limiting Sum (Rigorous Definition)

More resources available at www.misterwootube.com

From playlist Modelling Financial Situations