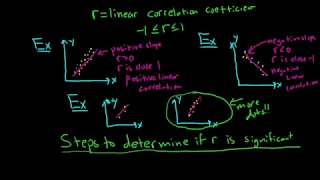

RELATIONSHIPS Between Variables: Standardized Covariance (7-1)

Correlation is a way of measuring the extent to which two variables are related. The term correlation is synonymous with “relationship.” Variables are related when changes in one variable are consistently associated with changes in another variable. Dr. Daniel reviews Variance, Covariance,

From playlist Correlation And Regression in Statistics (WK 07 - QBA 237)

Conceptual Questions about Correlation

Please Subscribe here, thank you!!! https://goo.gl/JQ8Nys Conceptual Questions about Correlation

From playlist Statistics

What are Swaps? Financial Derivatives Tutorial

In todays video we learn about Swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/Patrick

From playlist Swaps

In todays video we learn about currency swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.co

From playlist Swaps

Covariance Definition and Example

What is covariance? How do I find it? Step by step example of a solved covariance problem for a sample, along with an explanation of what the results mean and how it compares to correlation. 00:00 Overview 03:01 Positive, Negative, Zero Correlation 03:19 Covariance for a Sample Example

From playlist Correlation

Correlation does not Imply Causality, but then again… (7-4)

Correlation Does Not Imply Causation. When we see a correlation, we should not assume a cause-and-effect relationship between the variables. Correlation does not mean one isn’t causing the other, either; we just need more information. The correlation between two variables may be caused by

From playlist Correlation And Regression in Statistics (WK 07 - QBA 237)

What are Variance Swaps? Financial Derivatives - Trading Volatility

In todays video we learn about variance swaps These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com

From playlist Volatility and Variance Swaps

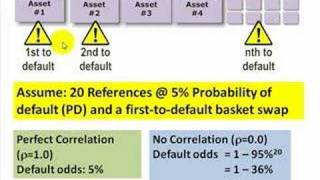

FRM: Basket credit default swap (CDS)

Like a CDS, but the reference is a BASKET of several obligations. A 1st-to-default means that the basket is triggered when the first obligation defaults. For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Derivatives: Credit Derivatives

Swap Monte Carlo Method and its Enormous Impact In the Study of Structural... by Smarajit Karmakar

DISCUSSION MEETING : CELEBRATING THE SCIENCE OF GIORGIO PARISI (ONLINE) ORGANIZERS : Chandan Dasgupta (ICTS-TIFR, India), Abhishek Dhar (ICTS-TIFR, India), Smarajit Karmakar (TIFR-Hyderabad, India) and Samriddhi Sankar Ray (ICTS-TIFR, India) DATE : 15 December 2021 to 17 December 2021 VE

From playlist Celebrating the Science of Giorgio Parisi (ONLINE)

Default correlation in CDO or basket CDS

As default correlation increases, the probability of default (PD) for junior tranche (1st to default basket CDS) decreases but the PD for a senior tranche increases.

From playlist Derivatives: Credit Derivatives

Correlation For Traders and Investors | Statistics For the Trading Floor | Correlation Trading

Correlation For Traders and Investors Today we will be discussing what correlation is and why it matters to traders and investors. We will learn why stock market correlation is so high right now and why investors might care. Watch to the end of the video to learn how traders can profit fr

From playlist Statistics For Traders

A CLN is similar to a credit default swap (CDS): both transfer credit risk to investors. However, the CLN is FUNDED; the bond owner does not really incur counterparty risk. Instead, the investors (CLN Buyers) incur counterparty risk. Plus, they are concerned with correlation between the CL

From playlist Derivatives: Credit Derivatives

Entropy in Self-Assembly (Lecture 3) by Francesco Sciortino

Program Entropy, Information and Order in Soft Matter ORGANIZERS: Bulbul Chakraborty, Pinaki Chaudhuri, Chandan Dasgupta, Marjolein Dijkstra, Smarajit Karmakar, Vijaykumar Krishnamurthy, Jorge Kurchan, Madan Rao, Srikanth Sastry and Francesco Sciortino DATE: 27 August 2018 to 02 November

From playlist Entropy, Information and Order in Soft Matter

Please Subscribe here, thank you!!! https://goo.gl/JQ8Nys Introduction to Correlation

From playlist Statistics

The recipe for moments of L-functions and characteristic polynomials of random mat... - Sieg Baluyot

50 Years of Number Theory and Random Matrix Theory Conference Topic: The recipe for moments of L-functions and characteristic polynomials of random matrices Speaker: Sieg Baluyot Affiliation: American Institute of Mathematics Date: June 23, 2022 In 2005, Conrey, Farmer, Keating, Rubinste

From playlist Mathematics

GRCon21 - Passive bistatic RADAR using spaceborne Sentinel1 non-cooperative source...

Passive bistatic RADAR using spaceborne Sentinel1 non-cooperative source, a B210 and a Raspberry Pi4 presented by Jean-Michel Friedt and Weike Feng at GNU Radio Conference 2021 We have previously demonstrated passive bi-static RADAR using a static emitter and static (passive bistatic RADA

From playlist GRCon 2021

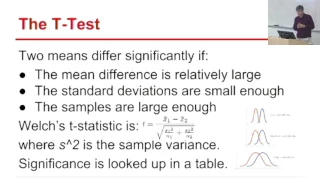

Lecture 11 - Statistical Significance

This is Lecture 11 of the CSE519 (Data Science) course taught by Professor Steven Skiena [http://www.cs.stonybrook.edu/~skiena/] at Stony Brook University in 2016. The lecture slides are available at: http://www.cs.stonybrook.edu/~skiena/519 More information may be found here: http://www

From playlist CSE519 - Data Science Fall 2016