Volatility Arbitrage - How does it work? - Options Trading Lessons

What is Volatility Arbitrage? Volatility arbitrage is a trading strategy that attempts to profit from the difference between the forecasted price-volatility of an asset, like a stock, and the implied volatility of options on that asset. These classes are all based on the book Trading and

From playlist Class 4 The Greeks & Dynamic Hedging

Merger Arbitrage Hedge Fund Strategy ― How Does it Work?

#mergerarbitrage #hedgefunds #trading #riskarbitrage Merger Arbitrage is an absolute return hedge fund trading strategy that aims to profit from predictable moves in stock prices that occur once a merger deal has been announced. 2020 has not been a great period for this strategy as a numbe

From playlist Corporate Finance

Make Money Betting on Politics - Arbitrage with Predictit

Step-by-step tutorial to find and profit from arbitrage opportunities on Predictit. Predictit is market with unique attributes that makes it the perfect place for arbitrage: it is closed to big players like banks and hedge funds, and it lets you bet on political outcomes. - PredictIt arb

From playlist Finance, Probability, and Other Stuff

Arbitrage Pricing Theory (APT)

APT is similar to CAPM but with several factors

From playlist Intro to Quant Finance

Pricing Financial Futures (Part 1 of 2)

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle Pricing Futures: When the deli

From playlist Class 1 Futures & Forwards

Monique Jeanblanc: Arbitrages in a progressive enlargement of filtration

Find this video and other talks given by worldwide mathematicians on CIRM's Audiovisual Mathematics Library: http://library.cirm-math.fr. And discover all its functionalities: - Chapter markers and keywords to watch the parts of your choice in the video - Videos enriched with abstracts, b

From playlist Probability and Statistics

Pricing Financial Futures (Part 2 of 2)

Today we will learn about pricing financial futures These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitt

From playlist Class 1 Futures & Forwards

Fixed Income: Arbitrage to exploit violation of law of one price (FRM T4-24)

Financial Risk Manager (FRM), Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 1, Prices Discount Factors and Arbitrage. How do we exploit the Law of One Price (which asserts that--absent confounding factors like liquidity or taxes--is only one set of discount factor

From playlist Valuation and RIsk Models (FRM Topic 4)

Matteo Burzoni: Viability and arbitrage under Knightian uncertainty

Abstract: We provide a general framework to study viability and arbitrage in models for financial markets. Viability is intended as the existence of a preference relation with the following properties: It is consistent with a set of preferences representing all the plausible agents trading

From playlist Probability and Statistics

Foundation of Risk Management -- Part 1 - Financial Risk Manager | Simplilearn

🔥Explore Our Free Courses With Completion Certificate by SkillUp: https://www.simplilearn.com/skillup-free-online-courses?utm_campaign=FoundationofRiskManagement&utm_medium=DescriptionFirstFold&utm_source=youtube This video talks about: 1.Foundation of Risk Management -- Part 1. 2.Arbitra

From playlist FRM Tutorial | Financial Risk Management Tutorial | Simplilearn

Daniel Balint: Discounting invariant FTAP for large financial markets

Abstract: For large financial markets as introduced in Kramkov and Kabanov 94, there are several existing absence-of-arbitrage conditions in the literature. They all have in common that they depend in a crucial way on the discounting factor. We introduce a new concept, generalizing NAA1 (K

From playlist Probability and Statistics

A conversation between Nassim Nicholas Taleb and Stephen Wolfram at the Wolfram Summer School 2021

Stephen Wolfram plays the role of Salonnière in this new, on-going series of intellectual explorations with special guests. Watch all of the conversations here: https://wolfr.am/youtube-sw-conversations Follow us on our official social media channels. Twitter: https://twitter.com/Wolfra

From playlist Conversations with Special Guests

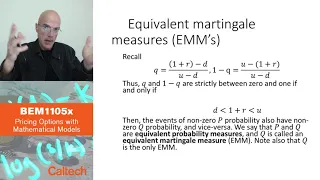

4 5 Fundamental theorems of asset pricing Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Financial Markets (ECON 252) Options introduce an essential nonlineary into portfolio management. They are contracts between buyers and writers, who agree on exercise prices and dates at which the buyer can buy or sell the underlying (such as a stock). Options are priced based on the pr

From playlist Financial Markets (2008) with Robert Shiller

4 2 Risk neutral pricing Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Reduced form Setting undr Model Uncertainty w/ Nonlinear Affine Intensities - Prof Francesca Biagini

Abstract In this talk we present a market model including financial assets and life insurance liabilities within a reduced-form framework under model uncertainty by following [1]. In particular we extend this framework to include mortality intensities following an affine process unde

From playlist Uncertainty and Risk

Prof. Frank Riedel - Frank Knight, the Economics of Uncertainty, and 21st Century Finance

A workshop to commemorate the centenary of publication of Frank Knight’s "Risk, Uncertainty, and Profit" and John Maynard Keynes’ “A Treatise on Probability” This workshop is organised by the University of Oxford and supported by The Alan Turing Institute. For further details and regular

From playlist Uncertainty and Risk

6. Irving Fisher's Impatience Theory of Interest

Financial Theory (ECON 251) Building on the general equilibrium setup solved in the last week, this lecture looks in depth at the relationships between productivity, patience, prices, allocations, and nominal and real interest rates. The solutions to three of Fisher's famous examples ar

From playlist Financial Theory with John Geanakoplos

What are Dividend Swaps, commodity swaps, equity swaps?

In todays video we will learn about Dividend Swaps, Commodity Swaps and Equity Swaps. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patri

From playlist Swaps

A conversation between Fred Meinberg and Stephen Wolfram at the Wolfram Summer School 2021

Stephen Wolfram plays the role of Salonnière in this new, on-going series of intellectual explorations with special guests. Watch all of the conversations here: https://wolfr.am/youtube-sw-conversations Follow us on our official social media channels. Twitter: https://twitter.com/Wolfram

From playlist Conversations with Special Guests