Arithmetic (mean) versus geometric (median) stock return

The expected return of a stock is ambiguous because, if we assume returns are normal, then price levels are lognormal. In which case, the mean does not equal the median future stock price.

From playlist Intro to Quant Finance

Expected Value Example and Intuitive Explanation

Please Subscribe here, thank you!!! https://goo.gl/JQ8Nys Expected Value Example and Intuitive Explanation

From playlist Statistics

Using Normal to bound future stock price interval

I show an application of the normal distribution: to bound a future stock price interval

From playlist Statistics: Distributions

Expected Value: Life Insurance

This video explains how to calculate an expected value of an event. http://mathispower4u.com

From playlist Probability

FRM: Intro credit risk: expected loan return

The expected return on a loan adjusts for default risk. If p = probability of repayment, then 1-p = probability of non-repayment. The expected non-repayment, E[loan amount*(1-p)], is an expected loss (EL) covered by loan loss provisions (a contra-asset account). A "cost of doing business"

From playlist Credit Risk: Introduction

Annual Rate of Return Need for Loss Recover and Additional Return on Investment

This video explains what rate of return is needed to recover from a loss as well as the rate of return needed to earn a certain rate of return moving forward. https://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

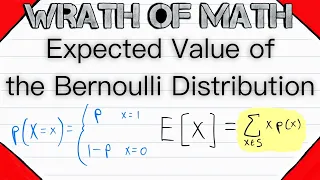

Expected Value of the Bernoulli Distribution | Probability Theory

How do we derive the mean or expected value of a Bernoulli random variable? We'll be going over that in today's probability theory lesson! Remember a Bernoulli random variable is a random variable that is equal to 1 (success) with probability p and equal to 0 (failure) with probability 1-

From playlist Probability Theory

Determine the Total Return of an Investment as Percent

This video explains how to calculate the total return on an investment as a percent. http://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

Diversification in Investing: Response to Meet Kevin, Kevin O'Leary, Graham Stephan.

#KevinOLeary #GrahamStephan #Response #MeetKevin Today's video is a response to a viewer question about a comment financial YouTuber "Meet Kevin" made on diversification in his reaction to a video where Kevin O'Leary recommended that Graham Stephan diversify his investment portfolio. We wi

From playlist Statistics For Traders

Policy Gradient Theorem Explained - Reinforcement Learning

In this video, I explain the policy gradient theorem used in reinforcement learning (RL). Instead of showing the typical mathematical derivation of the proof, I explain the resulting formula by walking through an example of playing a game and figuring out how we can estimate the policy gra

From playlist Machine Learning

4. Portfolio Diversification and Supporting Financial Institutions (CAPM Model)

Financial Markets (ECON 252) Portfolio diversification is the most fundamental concept of risk management. The allocation of financial resources in stocks, bonds, riskless, assets, oil and other assets determine the expected return and risk of a portfolio. Taking account of covariances

From playlist Financial Markets (2008) with Robert Shiller

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Applied Portfolio Management - Class 1 - Risk & Return

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Book Suggestions: Burton Malkiel, A Random Walk Down Wall Street (2007) https://amzn.to/2Hr2SW1 Roger Lowenstein, Buffett: The Making of an American Capitalist (2008) https://amzn.to/3hUkFl6 Jack Sc

From playlist Applied Portfolio Management

This is Lecture 17 of the COMP510 (Computational Finance) course taught by Professor Steven Skiena [http://www.cs.sunysb.edu/~skiena/] at Hong Kong University of Science and Technology in 2008. The lecture slides are available at: http://www.algorithm.cs.sunysb.edu/computationalfinance/pd

From playlist COMP510 - Computational Finance - 2007 HKUST

Capital asset pricing model (CAPM, FRM T1-9)

The CAPM is a ex ante single-factor model where the single-factor is the market's excess return: it says that we should expect an excess return that is proportional to the stock's beta, which is the stock's exposure to market's excess return, as measured by the stock's beta. Beta can be re

From playlist Risk Foundations (FRM Topic 1)

Ses 15: Portfolio Theory III & The CAPM and APT I

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

This video introduces and provides 2 examples of expected value. http://mathispower4u.com

From playlist Probability

DeepMind x UCL RL Lecture Series - Multi-step & Off Policy [11/13]

Research Scientist Hado van Hasselt discusses multi-step and off policy algorithms, including various techniques for variance reduction. Slides: https://dpmd.ai/offpolicy Full video lecture series: https://dpmd.ai/DeepMindxUCL21

From playlist Learning resources