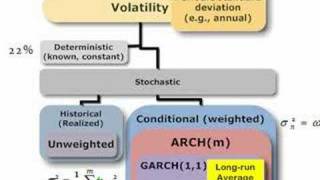

Lots of ways to estimate volatility. In this map, I parse out implied volatility (forward looking) and deterministic (constant) and focus on stochastic volatility: volatility that changes over time, either via (conditional) recent volatility and/or random shocks. For more financial risk vi

From playlist Volatility

Risk Management Lesson 4A: Volatility

First part of Lesson 4. Topics: - Definitions of volatility - Basic assumptions (do they hold?) - Arch and G-arch models (brief overview)

From playlist Risk Management

What are Volatility Swaps? Financial Derivatives - Trading Volatility

In todays class we learn about what a volatility swap is. These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https:/

From playlist The Term Structure of Volatility

Volatility Trading - Call and Put Options - Trading Tutorial

These classes are all based on the book Derivatives For The Trading Floor, available on Amazon at this link. https://amzn.to/3GdLi2s Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle What is volatility trading? Volatility

From playlist Class 4 The Greeks & Dynamic Hedging

11 Types of Taxes: Sales, Income, Capital Gains, and More

We know that government spending is funded by taxes. But how are these taxes collected? What should be taxed? Essentially there are three types of taxes. Taxes on what you buy, taxes on what you own, and taxes on what you earn. But more specifically, we have all heard of income taxes, capi

From playlist Economics

Time Varying Volatility and GARCH in Risk Management

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle In Todays video let's learn abo

From playlist Risk Management

Ses 17: The CAPM and APT III & Capital Budgeting I

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Asset Allocation Strategies for the New Decade

Martin Leibowitz, Managing Director, Morgan Stanley; Robert Litterman, Retired Partner, Goldman Sachs & Co.; and John L. (Launny) Steffens, Founder, Spring Mountain Capital June 17, 2010 The Einstein Legacy Society recognizes those friends of the Institute who have made a planned gift or

From playlist Einstein Legacy Society

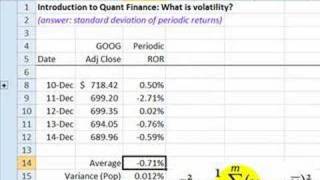

FRM: Intro to Quant Finance: Volatility

Volatility is the standard deviation of period returns. For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Intro to Quant Finance

MIT 15.S12 Blockchain and Money, Fall 2018 Instructor: Prof. Gary Gensler View the complete course: https://ocw.mit.edu/15-S12F18 YouTube Playlist: https://www.youtube.com/playlist?list=PLUl4u3cNGP63UUkfL0onkxF6MYgVa04Fn In this session, Prof. Gensler discusses how public policy relates t

From playlist MIT 15.S12 Blockchain and Money, Fall 2018

This is Lecture 17 of the COMP510 (Computational Finance) course taught by Professor Steven Skiena [http://www.cs.sunysb.edu/~skiena/] at Hong Kong University of Science and Technology in 2008. The lecture slides are available at: http://www.algorithm.cs.sunysb.edu/computationalfinance/pd

From playlist COMP510 - Computational Finance - 2007 HKUST

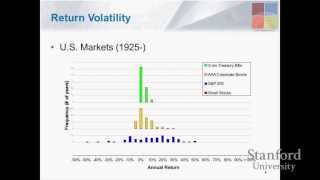

Applied Portfolio Management - Class 2 - Asset Classes & Returns

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Todays class is all about investment asset classes. We examine the different types of investment an investor can put their savings in and try to work out the expected return of these asset classes,

From playlist Applied Portfolio Management

Canadian Senate Testimony on Bitcoin

Andreas M. Antonopoulos presents expert witness testimony to the Canadian Senate Banking and Commerce Committee on October 8th 2014. He is a technologist and serial entrepreneur who has become one of the most well-known and respected figures in bitcoin. This talk is featured in The Intern

From playlist English Subtitles - aantonop Videos with subtitles in English

Unit 5 - taxes efficiency part 2

From playlist Courses and Series

Investing 101: Everything you Need to Know [Full Course]

Do you want to know how to invest like the Pros? Maybe you just want to be able to afford a house one day or retire early? Everyone has to get started somewhere - so in this Investing 101 course, we’re going to take you through everything that you need to know about investing. We’ll star

From playlist Concerning Finance

Terry Karl, Gildred Professor of Latin American Studies and professor of Political Science at Stanford University, discusses overcoming the resource curse. The Energy Seminar meets weekly during the academic year. For a list of upcoming talks, visit the events page at the Woods Institute f

From playlist Lecture Collection | Energy Seminar

FRM: How to calculate (simple) historical volatlity

Historical daily volatility is the square root of the daily variance estimate. If we assume 1. mean return = 0 and 2. MLE rather than unbiased estimate, then daily variance is AVERAGE SQUARED RETURN. For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Volatility

Stanford Webinar - Financing Innovation: Common Mistakes Even Great Investors Make

Innovation cannot happen without the funding to bring an idea to life. In this webinar Stanford Professor Peter DeMarzo, Senior Associate Dean of the Graduate School of Business and instructor within the Stanford Innovation and Entrepreneurship certificate, discusses how to value ideas and

From playlist Stanford Webinars

16. Central Banks & Commercial Banking, Part 2

MIT 15.S12 Blockchain and Money, Fall 2018 Instructor: Prof. Gary Gensler View the complete course: https://ocw.mit.edu/15-S12F18 YouTube Playlist: https://www.youtube.com/playlist?list=PLUl4u3cNGP63UUkfL0onkxF6MYgVa04Fn Prof. Gary Gensler continues the discussion about central banks and

From playlist MIT 15.S12 Blockchain and Money, Fall 2018

What is Implied Volatility? Options Trading Tutorial.

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle

From playlist The Term Structure of Volatility