Financial Theory (ECON 251) Our understanding of the economy will be more tangible and vivid if we can in principle explain all the economic decisions of every agent in the economy. This lecture demonstrates, with two examples, how the theory lets us calculate equilibrium prices and all

From playlist Financial Theory with John Geanakoplos

In this video I answer a question I received from a viewer. They want to know about mathematics for quantitative finance. They are specifically concerned with math for real analysis and probability. Do you have any advice or opinions? If so, please leave a comment. Quantative Finance Bo

From playlist Inspiration and Advice

2. Utilities, Endowments, and Equilibrium

Financial Theory (ECON 251) This lecture explains what an economic model is, and why it allows for counterfactual reasoning and often yields paradoxical conclusions. Typically, equilibrium is defined as the solution to a system of simultaneous equations. The most important economic mode

From playlist Financial Theory with John Geanakoplos

Introduction to Econometrics Toolbox in MATLAB

Get a Free Trial: https://goo.gl/C2Y9A5 Get Pricing Info: https://goo.gl/kDvGHt Ready to Buy: https://goo.gl/vsIeA5 Create a predictive time-series model of a stock index. For more videos, visit http://www.mathworks.com/products/econometrics/examples.html

From playlist Computational Finance

7. Behavioral Finance: The Role of Psychology

Financial Markets (ECON 252) Behavioral Finance is a relatively recent revolution in finance that applies insights from all of the social sciences to finance. New decision-making models incorporate psychology and sociology, among other disciplines, to explain economic and financial phen

From playlist Financial Markets (2008) with Robert Shiller

Mod-07 Lec-18 Financial Statements Analysis - Dabur India Case

Managerial Accounting by Dr. Varadraj Bapat,Department of Management,IIT Bombay.For more details on NPTEL visit http://nptel.ac.in

From playlist IIT Bombay: Managerial Accounting | CosmoLearning.org Accounting

Volatility: standard deviation (FRM T2-21)

[Here is my xls at https://trtl.bz/2kOmHb6] The simple, common approach to estimating volatility is historical standard deviation. Here is a thread about the decision to include/exclude the mean return: https://trtl.bz/2kLRK7z. Discuss this video here in our forum: https://trtl.bz/2HMhjk2

From playlist Quantitative Analysis (FRM Topic 2)

2012 FRM Quantitative Analysis T2.a

This is a sample of our 2012 FRM Quantitative Analysis T2.a video tutorials. View our products here: https://www.bionicturtle.com/products/financial-risk-management/ The Bionic Turtle program is the most effective and affordable preparation aid for the Financial Risk Manager (FRM) exam.

From playlist FRM

Financial Option Theory with Mathematica -- Volatility, and direct solution of PDEs

This is my third session of my track about Financial Option Theory with Mathematica. I first develop two methods to compute historical volatility of a stock. Next I do the same for an estimate of the historical appreciation rate. I then come to the very important topic of the implied volat

From playlist Financial Options Theory with Mathematica

Macroeconomic impacts of stranded fossil fuel assets - Mercure - Workshop 3 - CEB T3 2019

Mercure (University of Exeter) / 05.12.2019 Macroeconomic impacts of stranded fossil fuel assets ---------------------------------- Vous pouvez nous rejoindre sur les réseaux sociaux pour suivre nos actualités. Facebook : https://www.facebook.com/InstitutHenriPoincare/ Twitter :

From playlist 2019 - T3 - The Mathematics of Climate and the Environment

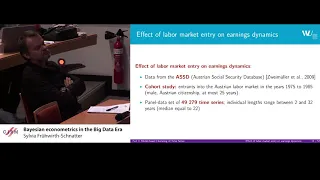

Sylvia Frühwirth-Schnatter: Bayesian econometrics in the Big Data Era

Abstract: Data mining methods based on finite mixture models are quite common in many areas of applied science, such as marketing, to segment data and to identify subgroups with specific features. Recent work shows that these methods are also useful in micro econometrics to analyze the beh

From playlist Probability and Statistics

Level 1 Chartered Financial Analyst (CFA ®): Sampling and Estimation

In this video, I'm looking forward to sharing highlights with you from the CFA section, sampling and estimation. Sampling and estimation in statistics are theoretically essential and foundational, but in actual practice, it's very important. This is the practice of using samples to draw in

From playlist Level 1 Chartered Financial Analyst (CFA ®) Volume 1

Data Science - Part XVI - Fourier Analysis

For downloadable versions of these lectures, please go to the following link: http://www.slideshare.net/DerekKane/presentations https://github.com/DerekKane/YouTube-Tutorials This lecture provides an overview of the Fourier Analysis and the Fourier Transform as applied in Machine Learnin

From playlist Data Science

FRM Part 1 Focus Review: 2nd of 8 (Quantitative)

This is a sample of our 2012 FRM Part 1 Focus Review: 2nd of 8 (Quantitative) video tutorial. For more financial risk management videos, visit our website! http://www.bionicturtle.com

From playlist FRM

MIT 14.04 Intermediate Microeconomic Theory, Fall 2020 Instructor: Prof. Robert Townsend View the complete course: https://ocw.mit.edu/courses/14-04-intermediate-microeconomic-theory-fall-2020/ YouTube Playlist: https://www.youtube.com/playlist?list=PLUl4u3cNGP63wnrKge9vllow3Y2OOOKqF Prof

From playlist MIT 14.04 Intermediate Microeconomic Theory, Fall 2020

AIUK: Machine learning for finance

From the algorithms responsible for credit decision making to the intuitive technology protecting us from fraud – some of the earliest adoption of AI-driven processes have come from the financial and economic sector. Today, it continues to be a main driver for opportunity in the financial

From playlist AIUK 2021

Professor Mike West: Structured Dynamic Graphical Models & Scaling Multivariate Time Series

The Turing Lectures - Professor Mike West: Structured Dynamic Graphical Models & Scaling Multivariate Time Series. Click the below timestamps to navigate the video. 00:00:12 Welcome & Introduction by Doctor Ioanna Manolopoulou 00:01:19 Professor Mike West: Structured Dynamic

From playlist Turing Lectures

What's the difference between Microeconomics and Macroeconomics? "Episode 4: Micro vs Macro" by Dr. Mary J. McGlasson is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

From playlist Microeconomics modules

Applied Machine Learning: Introduction

Professor Jann Spiess presents an introduction to applied machine learning.

From playlist Machine Learning & Causal Inference: A Short Course