Present Value Tables (1 of 2: What do they mean?)

More resources available at www.misterwootube.com

From playlist Modelling Financial Situations

Present & Future Value (2 of 2: Using formula to work out present value)

More resources available at www.misterwootube.com

From playlist Annuities

In this video, we discuss some of the based ideas around the future value of money.

From playlist Personal Finance

Ex: Present Value of One Time Investment Given Future Value

This video provides an example of how to determine the present value of a one time investment that earns continuous interest given the future value. Search Complete Library at www.mathispower4u.wordpress.com

From playlist Business Applications of Integration

Present value of a single deposit, compounded continuously - How do you find it?

► My Applications of Integrals course: https://www.kristakingmath.com/applications-of-integrals-course In this video we’re looking at how to find the present value of a one-time deposit, when interest is compounded continuously. Skip to section: 0:28 // What is a single deposit? What do

From playlist Calculus II

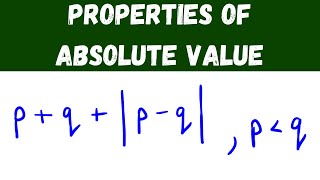

Math 023 Fall 2022 090722 Absolute Values (continued)

Recall: what is the definition of the absolute value? Exercise: what is |-x| if x is negative? What is |x| if x is negative? Properties of the absolute value. Examples. Geometric interpretation of |x-y| as the distance between x and y. Examples: using that interpretation to describe

From playlist Course 1: Precalculus (Fall 2022)

In this video I go through the various properties of absolute value. In the 8 examples I cover, I go over concepts such as the piecewise definition of absolute value, dividing absolute value expressions, multiplying absolute value expressions, and simplifying absolute value expressions.

From playlist Pre-Calculus

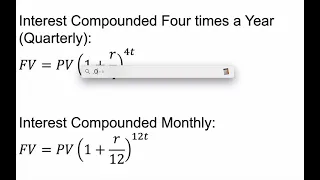

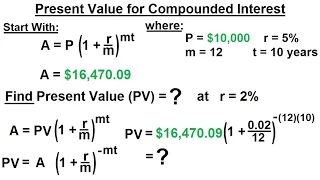

Business Math - Finance Math (9 of 30) Present Value for Compounded Interest

Visit http://ilectureonline.com for more math and science lectures! In this video I will explain and find the present value for compounded interest of an $1000 investment at 5% for 1 year compounded monthly. Next video in this series can be seen at: http://youtu.be/ADpfhW2K39o

From playlist BUSINESS MATH 2 FINANCE MATH

Level 1 Chartered Financial Analyst (CFA ®): Time value of Money (TVM), Part 2

Session 2, Reading 6 (Part 2): An Annuity is a finite set of level sequential cash flows. An Ordinary Annuity has a first cash flow that occurs one period from now (indexed at t = 1). An Annuity Due has a first cash flow that occurs immediately (indexed at t = 0). A Perpetuity is a perpetu

From playlist Level 1 Chartered Financial Analyst (CFA ®) Volume 1

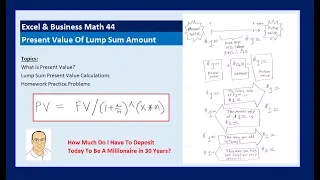

Excel & Business Math 44: What is Present Value? Calculate Present Value Of Lump Sum Amount.

Download Start Excel File: https://people.highline.edu/mgirvin/AllClasses/135NoTextBook/Content/07Finance/ExcelBusinessMathVideo44PresentValue.xlsx Download pdf Notes: https://people.highline.edu/mgirvin/AllClasses/135NoTextBook/Content/07Finance/ExcelBusinessMathVideo44PresentValue.pdf En

From playlist Excel & Business Math Class: % Change Formulas, Invoicing, Payroll, Finance & More (45 Videos)

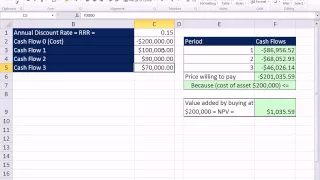

Excel Finance Class 68: Net Present Value, NPV Excel Function & Capital Budgeting

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch08.xls Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233ch8.ppt Learn about : Net Present Value, NPV Excel Function & Capital Budgeting.

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

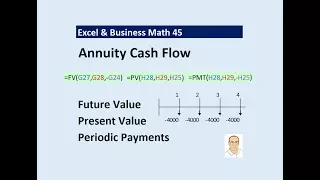

Excel & Business Math 45: Future Value, Present Value and Periodic Payments for Annuities

Download Start Excel File: https://people.highline.edu/mgirvin/AllClasses/135NoTextBook/Content/07Finance/ExcelBusinessMathVideo45AnnuitiesFVandPV.xlsx Download pdf Notes: https://people.highline.edu/mgirvin/AllClasses/135NoTextBook/Content/07Finance/ExcelBusinessMathVideo45AnnuitiesFVandP

From playlist Excel & Business Math Class: % Change Formulas, Invoicing, Payroll, Finance & More (45 Videos)

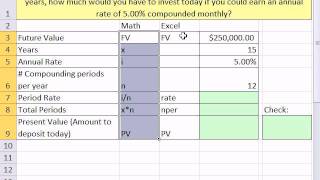

Excel 2010 Business Math 83: Present Value of FV Lump Sum: How Much To Put In Bank?

Download Excel File: https://people.highline.edu/mgirvin/AllClasses/135_2011/Content/Ch10/Excel2010BusnMathCh10.xlsx Download pdf file #1: https://people.highline.edu/mgirvin/AllClasses/135_2011/Content/Ch10/BusnMathCh10.pdf Download pdf file #2: https://people.highline.edu/mgirvin/AllClas

From playlist Excel 2010 Business Math Class

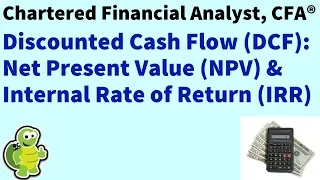

Level 1 Chartered Financial Analyst (CFA ®): Discounted Cash Flow & Internal Rate Return (DCF, IRR)

Session 2, Reading 7 (Part 1): Here we look at the calculation and interpretation of two of the most popular decision-making tools in corporate finance: Net Present Value and Internal Rate of Return. 💡 Discuss this video here in our forum: https://trtl.bz/2IIgbye. 👉 Subscribe here https:

From playlist Level 1 Chartered Financial Analyst (CFA ®) Volume 1

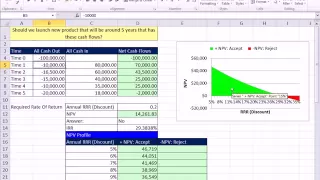

Excel Finance Class 69: Net Present Value Profile -- Build Table and Chart in Excel NPV Function

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch08.xls Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233ch8.ppt Learn how to create a Net Present Value Profile table and chart in Excel. See the cross over point where I

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

This personal finance video tutorial explains how to calculate the net present value NPV of a series of cash inflows and a single cash outflow. It also explains how to calculate the profitability index PI as well as the internal rate of return IRR using excel. My Website: https://www.vi

From playlist Personal Finance

Financial Theory (ECON 251) In this lecture we move from present values to dynamic present values. If interest rates evolve along the forward curve, then the present value of the remaining cash flows of any instrument will evolve in a predictable trajectory. The fastest way to compute

From playlist Financial Theory with John Geanakoplos

Present Value Tables (2 of 2: Practical application)

More resources available at www.misterwootube.com

From playlist Modelling Financial Situations