Present Value Tables (1 of 2: What do they mean?)

More resources available at www.misterwootube.com

From playlist Modelling Financial Situations

Present & Future Value (2 of 2: Using formula to work out present value)

More resources available at www.misterwootube.com

From playlist Annuities

Ex: Present Value of One Time Investment Given Future Value

This video provides an example of how to determine the present value of a one time investment that earns continuous interest given the future value. Search Complete Library at www.mathispower4u.wordpress.com

From playlist Business Applications of Integration

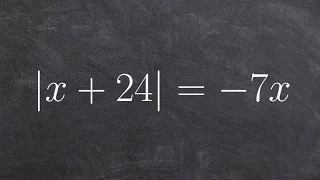

Solving an Absolute Value Equation and Checking for Extraneous Solutions

Learn how to solve absolute value equations with extraneous solutions. Absolute value of a number is the positive value of the number. For instance, the absolute value of 2 is 2 and the absolute value of -2 is also 2. To solve an absolute value problem, we first isolate the absolute value

From playlist Solve Absolute Value Equations

Determining The Value of an Annuity

This video defines an annuity and uses a formula to determine the value of an annuity over a period of time. http://mathispower4u.wordpress.com/

From playlist Financial Math

Learn How To Solve an Absolute Value Equation and Check Your Answers

Learn how to solve absolute value equations with extraneous solutions. Absolute value of a number is the positive value of the number. For instance, the absolute value of 2 is 2 and the absolute value of -2 is also 2. To solve an absolute value problem, we first isolate the absolute value

From playlist Solve Absolute Value Equations

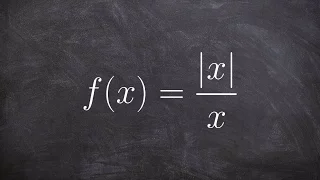

Learn how to evaluate left and right hand limits of a function

👉 Learn how to evaluate the limit of an absolute value function. The limit of a function as the input variable of the function tends to a number/value is the number/value which the function approaches at that time. The absolute value function is a function which only takes the positive val

From playlist Evaluate Limits of Absolute Value

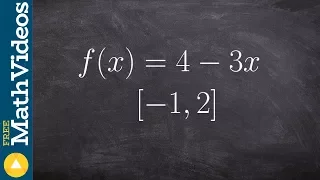

Find the max and min of a linear function on the closed interval

👉 Learn how to find the extreme values of a function using the extreme value theorem. The extreme values of a function are the points/intervals where the graph is decreasing, increasing, or has an inflection point. A theorem which guarantees the existence of the maximum and minimum points

From playlist Extreme Value Theorem of Functions

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

This personal finance video tutorial explains how to calculate the net present value NPV of a series of cash inflows and a single cash outflow. It also explains how to calculate the profitability index PI as well as the internal rate of return IRR using excel. My Website: https://www.vi

From playlist Personal Finance

FRM: Valuation of credit default swap (CDS)

The key idea in valuing a CDS is a fair deal: the (probability-adjusted) expected PAYMENTS (i.e., made by protection buyer) should equal the expected PAYOFF (contingent, made by seller). For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Derivatives: Credit Derivatives

Multilayer Neural Networks - Part 4b: Backprogation

This video is about Multilayer Neural Networks - Part 4b: Backprogation Abstract: This is a series of video about multi-layer neural networks, which will walk through the introduction, the architecture of feedforward fully-connected neural network and its working principle, the working pr

From playlist Machine Learning

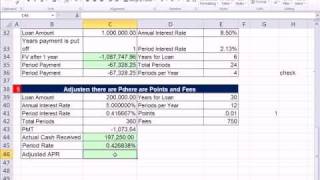

Excel Finance Class 36: PMT Function 7 Examples & Adjusted APR with Points and RATE function

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch05.xlsx Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Ch05Busn233.pdf Download deductive proof pdf: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/DeductiveProofAnnuityFor

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

2017 Adlai E. Stevenson (Team 8597) Presentation

Adlai E. Stevenson High School from Lincolnshire, IL was the winning team in the 2017 Moody's Mega Math Challenge - congratulations! This year, more than 5,000 high school students from across the U.S. used mathematical modeling to recommend solutions for the future growth and sustainabili

From playlist M3 Challenge

Valuation Navigator and the Emergence of Real Estate Valuation 3.0

For the latest information, please visit: http://www.wolfram.com Speaker: Shashi Rivankar Wolfram developers and colleagues discussed the latest in innovative technologies for cloud computing, interactive deployment, mobile devices, and more.

From playlist Wolfram Technology Conference 2015

Accounting Lecture 04 - Adjusting Entries for Deferrals

From the free study guides and course manuals at www.my-accounting-tutor.com. Adjusting entries for supplies, prepaid assets, depreciation, and unearned revenues. Part I of two parts.

From playlist Accounting Lectures

From playlist Contributed talks One World Symposium 2020

How To Solve an Absolute Value Equation when There is Only One Solution

Learn how to solve absolute value equations with extraneous solutions. Absolute value of a number is the positive value of the number. For instance, the absolute value of 2 is 2 and the absolute value of -2 is also 2. To solve an absolute value problem, we first isolate the absolute value

From playlist Solve Absolute Value Equations

How to determine the global max and min from a piecewise function

👉 Learn how to find the extreme values of a function using the extreme value theorem. The extreme values of a function are the points/intervals where the graph is decreasing, increasing, or has an inflection point. A theorem which guarantees the existence of the maximum and minimum points

From playlist Extreme Value Theorem of Functions

Applied Portfolio Management - Video 4 - Fixed Income Asset Management

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest

From playlist Applied Portfolio Management