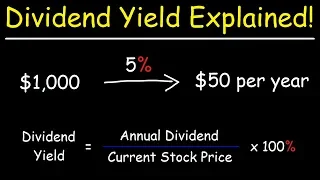

The Dividend Yield - Basic Overview

This video provides a basic introduction into the dividend yield. It explains what it's used for and how to calculate it. The dividend yield is equal to the annual dividend divided by the current stock price times 100%. The annual dividend is equal to the quarterly dividend times 4 or t

From playlist Stocks and Bonds

Annual Percentage Rate vs Annual Percentage Yield

This video explains how to determine the annual percentage rate (APR) charged by a payday loan company and how to calculate the annual percentage yield charged by a credit card company. Investing In Bonds: https://www.youtube.com/watch?v=OnkmoSTeHuc The Dividend Yield: https://www.youtub

From playlist Personal Finance

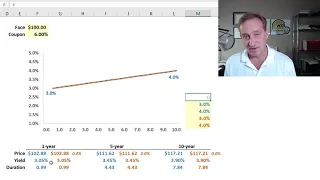

Fixed Income: Twists are steepening or flattening of the yield curve (FRM T4-23)

[my xls is here https://trtl.bz/2v5jXvc] The drawback of yield-based duration and convexity is that implicitly they must assume a parallel shift in the rate curve. While there can be many non-parallel shift, the two most common are twists and butterflies. A twist is when the curve steepens

From playlist Valuation and RIsk Models (FRM Topic 4)

The yield (aka, yield to maturity, YTM) is the single rate that correctly prices the bond; it impounds the spot rate curve. For each coupon bond, there is a different implied yield. The PAR YIELD is the yield (YTM) for a bond that happens to price at par, and therefore is equal to this bon

From playlist Bonds: Yields

Covariance (17 of 17) A Practical Example for the Covariance: Example 3

Visit http://ilectureonline.com for more math and science lectures! To donate:a http://www.ilectureonline.com/donate https://www.patreon.com/user?u=3236071 We will find the covariance matrix and of a practical example of EVEN MORE fertilizer used (x) and crop yield (y). Example 3 First

From playlist COVARIANCE AND VARIANCE

Using Normal to bound future stock price interval

I show an application of the normal distribution: to bound a future stock price interval

From playlist Statistics: Distributions

Effective Yield for Countinuous Interest

This video derives the effective yield formula and shows how to determine effective yield using the formula. http://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

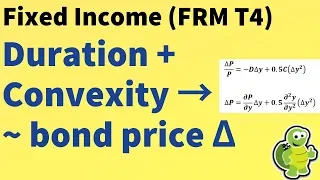

Fixed Income: Duration plus convexity to approximate bond price change (FRM T4-38)

Duration plus a convexity adjustment is a good estimate (approximation) of the bond's price change. We can express this change in percentage terms(%) as given by ΔP/P = -D*Δy + 0.5*C*(Δy)^2; or we can express this in dollar terms ($) as given by ΔP =∂P/∂y*Δy + 0.5*∂^2P/∂y^2*(Δy)^2. 💡 Dis

From playlist Valuation and RIsk Models (FRM Topic 4)

Effective Yield for Compounded Interest

This video derives the effective yield formula and shows how to determine effective yield using the formula. http://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

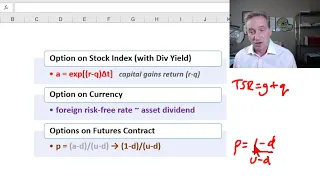

Binomial option pricing model for equity index, currencies, and futures options (FRM T4-9)

[here is my xls https://trtl.bz/2AZLCkA] Using a three-step binomial to price "options on other assets" (Hull 13.11 10th edition): equity index option, currency options and futures options (aka, options on futures contracts). The key difference is the calculation of p = probability of an u

From playlist Valuation and RIsk Models (FRM Topic 4)

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Applied Portfolio Management - Video 4 - Fixed Income Asset Management

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest

From playlist Applied Portfolio Management

Make Potassium Chlorate by Electrolysis - The Basic Guide

In this video we show how to make potassium chlorate from potassium chloride by electrolysis. For the anode, carbon, platinum or mixed metal oxide works best. For the cathode, almost any metal can be used but titanium is preferred. The electrodes are simply inserted into a solution of p

From playlist Fire & Pyro

Character Locomotion in Half-Life: Alyx - SIGGRAPH 2021

An overview of the gameplay locomotion animation systems developed for the VR-exclusive game Half-Life: Alyx by Valve Software. Originally presented (virtually) at SIGGRAPH 2021. More detail is available in the slides at https://www.valvesoftware.com/en/publications

From playlist Math 1171 (Calculus 1) Fall 2021

Determining the Effective Yield of an Investment on the TI84

This video shows how to determine the effective yield of an investment account on the TI84. http://mathispower4u.wordpress.com/

From playlist TI-84: Financial Mathematics

Make in India initiative, Part 1 of 2 - labor, land and tax reforms

Support CaspianReport through Patreon: https://www.patreon.com/CaspianReport BAKU - India’s economic growth in 2015 was a staggering 7.3 percent increase in GDP. Yet, the country cannot create enough jobs to lift its people from poverty. It has a labor force of 502 million people, yet 49

From playlist Economics

How Solar Panels Are Changing Agriculture - Agrivoltaics Revisited

How Solar Panels Are Changing Agriculture - Agrivoltaics Revisited. Visit the SPAN website to get a quote and start the process of having SPAN in your home https://link.undecidedmf.com/span2. Experiments in agrivoltaics (solar panels plus farming) have had some really promising results ove

From playlist How and Why

Credit Spread Options (Put & Call)

A credit spread option is a hedge/bet on the narrowing or widening of a credit spread (credit spread = risky yield - riskless yield). The credit spread put payoff = duration x notional x MAX [Credit Spread - Strike Spread, 0]. The Credit spread call payoff = duration x notional x MAX [Stri

From playlist Derivatives: Credit Derivatives

Fixed Income: Simple bond illustrating all three durations (effective, mod, Mac) (FRM T4-36)

Macaulay duration is the bond's weighted average maturity (where the weights are each cash flow's present value as a percent of the bond's price; in this example, the bond's Macaulay duration is 2.8543 years. Modified duration is the true (best) measure of interest rate risk; in this examp

From playlist Valuation and RIsk Models (FRM Topic 4)

GCSE Science Revision Chemistry "Calculating Percentage Yield 2" (Triple)

Find my revision workbooks here: https://www.freesciencelessons.co.uk/workbooks In this video, which is the second of two, we continue to look at how to calculate the percentage yield for a reaction. I give you two examples of the calculation for you to try and then I go through the answe

From playlist 9-1 GCSE Chemistry Paper 1 Quantitative Chemistry