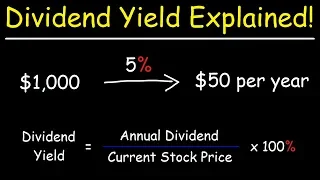

The Dividend Yield - Basic Overview

This video provides a basic introduction into the dividend yield. It explains what it's used for and how to calculate it. The dividend yield is equal to the annual dividend divided by the current stock price times 100%. The annual dividend is equal to the quarterly dividend times 4 or t

From playlist Stocks and Bonds

The yield (aka, yield to maturity, YTM) is the single rate that correctly prices the bond; it impounds the spot rate curve. For each coupon bond, there is a different implied yield. The PAR YIELD is the yield (YTM) for a bond that happens to price at par, and therefore is equal to this bon

From playlist Bonds: Yields

Fin Math L8-3: EU Call with dividend-paying asset

Welcome to Financial Mathematics. In the last video of lesson 8 we consider a EU call when the underlying asset pays a dividend. We will see that there are some important differences in the way we approach the problem and in the final "formula". The dividend yield q plays indeed a major ro

From playlist Financial Mathematics

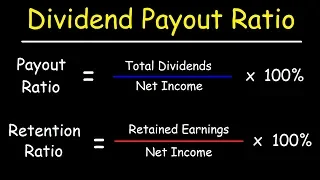

Dividends - Payout Ratio vs Retention Ratio

This stocks and bonds video tutorial explains how to calculate the dividend payout ratio and the retention ratio. The payout ratio is equal to the total dividends paid divided by the net income. The retention ratio is equal to the earnings retained divided by the net income. My Website:

From playlist Stocks and Bonds

Annual Percentage Rate vs Annual Percentage Yield

This video explains how to determine the annual percentage rate (APR) charged by a payday loan company and how to calculate the annual percentage yield charged by a credit card company. Investing In Bonds: https://www.youtube.com/watch?v=OnkmoSTeHuc The Dividend Yield: https://www.youtub

From playlist Personal Finance

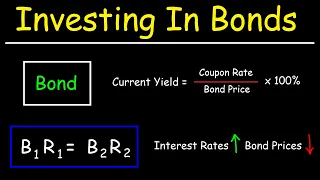

Intro to Investing In Bonds - Current Yield, Yield to Maturity, Bond Prices & Interest Rates

This video provides a basic introduction into investing in bonds. It explains how to calculate the total price paid for a number of bonds, how to calculate the semi-annual coupon payments of a bond, and how to calculate the current yield of a bond as well as estimate the yield to maturity

From playlist Stocks and Bonds

In this video, we look at a basic return on investment calculation.

From playlist Personal Finance

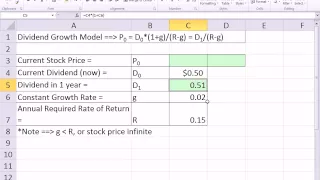

Excel Finance Class 66: Calculate Implied Return using Dividend Growth Model

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch07.xls Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/NYSEFlorrDrawing.pdf Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233ch7.ppt Learn how t

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

Excel Finance Class 63: Stock Valuation with Dividend Growth Model

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch07.xls Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/NYSEFlorrDrawing.pdf Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233ch7.ppt Learn about

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

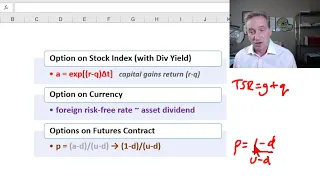

Binomial option pricing model for equity index, currencies, and futures options (FRM T4-9)

[here is my xls https://trtl.bz/2AZLCkA] Using a three-step binomial to price "options on other assets" (Hull 13.11 10th edition): equity index option, currency options and futures options (aka, options on futures contracts). The key difference is the calculation of p = probability of an u

From playlist Valuation and RIsk Models (FRM Topic 4)

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

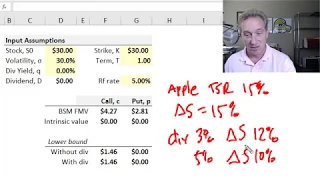

Is it optimal to early exercise an option? (FRM T3-36)

[my xls is here https://trtl.bz/2CwZS6J] It is never optimal to early exercise a call option on a non-dividend-paying stock but it may be advisable to early exercise a call on a dividend-paying stock. For a put option, it is maybe optimal to early exercise a put on EITHER a dividend- or no

From playlist Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

Lower bounds for European stock option prices (FRM T3-35)

[here is the xls https://trtl.bz/2BYKn6P] The lower bound for the price of a European call option is given by max[0, S(0) - K*exp(-rT) - D]. The lower bound for the price of a European put option is given by max[0, K*exp(-rT) - S(0) + D], where D is the lump-sum PV of the dividend. Where q

From playlist Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

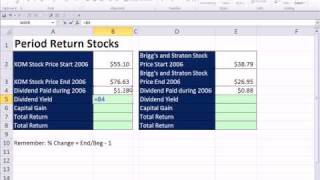

Excel Finance Class 90: Period (Holding) Returns For Stock

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch10.xlsx Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Bsun233Ch10.pptx Learn how to: 1. Dividend Yield 2. Capital Gain Yield 3. Total Return for the year, where or not you

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).