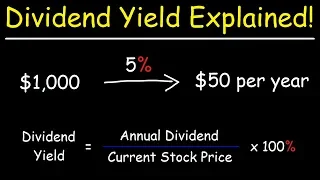

The Dividend Yield - Basic Overview

This video provides a basic introduction into the dividend yield. It explains what it's used for and how to calculate it. The dividend yield is equal to the annual dividend divided by the current stock price times 100%. The annual dividend is equal to the quarterly dividend times 4 or t

From playlist Stocks and Bonds

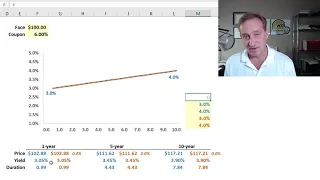

The yield (aka, yield to maturity, YTM) is the single rate that correctly prices the bond; it impounds the spot rate curve. For each coupon bond, there is a different implied yield. The PAR YIELD is the yield (YTM) for a bond that happens to price at par, and therefore is equal to this bon

From playlist Bonds: Yields

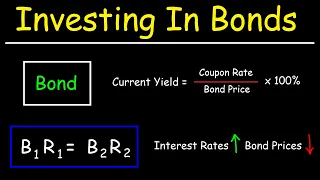

Intro to Investing In Bonds - Current Yield, Yield to Maturity, Bond Prices & Interest Rates

This video provides a basic introduction into investing in bonds. It explains how to calculate the total price paid for a number of bonds, how to calculate the semi-annual coupon payments of a bond, and how to calculate the current yield of a bond as well as estimate the yield to maturity

From playlist Stocks and Bonds

Annual Percentage Rate vs Annual Percentage Yield

This video explains how to determine the annual percentage rate (APR) charged by a payday loan company and how to calculate the annual percentage yield charged by a credit card company. Investing In Bonds: https://www.youtube.com/watch?v=OnkmoSTeHuc The Dividend Yield: https://www.youtub

From playlist Personal Finance

Yield to Maturity Interpretations (FRM T3-10)

[my xls is here https://trtl.bz/2HifflO] Superficially, the yield to maturity (YTM, aka yield) simply inverts the usual time value of money (TVM) inputs by solving for the yield as a function of four inputs: face (future) value, coupon (payment), maturity (time), and current price (present

From playlist Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

GCSE Science Revision Chemistry "Calculating Percentage Yield 2" (Triple)

Find my revision workbooks here: https://www.freesciencelessons.co.uk/workbooks In this video, which is the second of two, we continue to look at how to calculate the percentage yield for a reaction. I give you two examples of the calculation for you to try and then I go through the answe

From playlist 9-1 GCSE Chemistry Paper 1 Quantitative Chemistry

Today we will learn in financial futures what is convenience yield? These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here

From playlist Class 1 Futures & Forwards

Fixed Income: Twists are steepening or flattening of the yield curve (FRM T4-23)

[my xls is here https://trtl.bz/2v5jXvc] The drawback of yield-based duration and convexity is that implicitly they must assume a parallel shift in the rate curve. While there can be many non-parallel shift, the two most common are twists and butterflies. A twist is when the curve steepens

From playlist Valuation and RIsk Models (FRM Topic 4)

http://www.brightstorm.com/science/chemistry SUBSCRIBE FOR All OUR VIDEOS! https://www.youtube.com/subscription_center?add_user=brightstorm2 VISIT BRIGHTSTORM.com FOR TONS OF VIDEO TUTORIALS AND OTHER FEATURES! http://www.brightstorm.com/ LET'S CONNECT! Facebook ► https://www.facebook.c

From playlist Chemistry

Lec 7 | MIT 6.033 Computer System Engineering, Spring 2005

Virtual Processors: Threads and Coordination View the complete course at: http://ocw.mit.edu/6-033S05 License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 6.033 Computer System Engineering, Spring 2005

Unity - lesson 15 - coroutines

From playlist Unity game engine

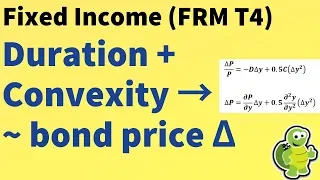

Fixed Income: Duration plus convexity to approximate bond price change (FRM T4-38)

Duration plus a convexity adjustment is a good estimate (approximation) of the bond's price change. We can express this change in percentage terms(%) as given by ΔP/P = -D*Δy + 0.5*C*(Δy)^2; or we can express this in dollar terms ($) as given by ΔP =∂P/∂y*Δy + 0.5*∂^2P/∂y^2*(Δy)^2. 💡 Dis

From playlist Valuation and RIsk Models (FRM Topic 4)

Python Tutorial: Context Managers - Efficiently Managing Resources

In this Python Programming Tutorial, we will be learning how to use context managers to properly manage resources. Context Managers are great for when we need to setup or teardown some resources during use. So these can be used for: open and closing files, opening and closing database conn

From playlist Python Tutorials

HEDS | The MegaJoule Direct Drive Campaign: NIF Experiments on the Pathway to MJ Yield

HEDS Seminar Series – Michael Rosenberg – April 22nd, 2021 LLNL-VIDEO-824862

From playlist High Energy Density Science Seminar Series

Excel Finance Class 66: Calculate Implied Return using Dividend Growth Model

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch07.xls Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/NYSEFlorrDrawing.pdf Download PowerPoints: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233ch7.ppt Learn how t

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

8. How a Long-Lived Institution Figures an Annual Budget. Yield

Financial Theory (ECON 251) In the 1990s, Yale discovered that it was faced with a deferred maintenance problem: the university hadn't properly planned for important renovations in many buildings. A large, one-time expenditure would be needed. How should Yale have covered these expenses

From playlist Financial Theory with John Geanakoplos

Effective Yield for Compounded Interest

This video derives the effective yield formula and shows how to determine effective yield using the formula. http://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić