Ex: Determine Exponential Growth Functions Given Growth Rate and Initial Value (y=ab^x)

This video provides examples on how to write an exponential growth function given the growth rate as a percentage and the initial value. Site: http://mathispower4u.com

From playlist Solving Applications of Exponential Growth and Decay

Exponential Growth Models - Part 2 of 2

http://mathispower4u.wordpress.com/

From playlist Exponential and Logarithmic Expressions and Equations

Write an Exponential Function for Growth over Different Time Intervals

This video explains how to write exponential functions to represent the value of an investment with percent increases over different time intervals.

From playlist Solving Applications of Exponential Growth and Decay

Ex: Exponential Functions: Growth Rate and Growth Factor

This video explains to to find the growth rate as a decimal and a percent and how to find the growth factor. Site: http://mathispower4u.com

From playlist Solving Applications of Exponential Growth and Decay

FRM: Time-weighted versus dollar-weighted (IRR) returns

Time-weighted returns (TWR) vs Dollar-weighted returns (DWR). For more Financial Risk Management videos, visit our website at http://www.bionicturtle.com!

From playlist FRM

Determine the Total Return of an Investment as Percent

This video explains how to calculate the total return on an investment as a percent. http://mathispower4u.com

From playlist Finance: Simple and Compounded Interest

Introduction to Engagement Rate | Marketing Analytics for Beginners | Part-12

Engagement rate measures the amount of interaction the content is generating relative to reach, impressions, and views. Engagement rate is one of the core metrics to measure the success of a digital marketing campaign. This video discusses the importance of engagement rate and different

From playlist Marketing Analytics for Beginners

Excel Finance Class 28: Relationship Between APR, Period Rate and Effective Annual Rate

Download Excel File: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Busn233Ch05.xlsx Download pdf notes: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/Ch05Busn233.pdf Download deductive proof pdf: https://people.highline.edu/mgirvin/YouTubeExcelIsFun/DeductiveProofAnnuityFor

From playlist Excel Finance Free Course at YouTube. Cash Flow Analysis and Model Building (110 Videos).

Fin Math L11: Numeraire, T-forward measure and interest rates

Welcome to Financial Mathematics. In this lesson we finally enter into the modeling of interest rates, which we will no longer consider constant. This implies that many things we have said until now need to be updated and generalised in order to still hold. The new chapter is available he

From playlist Financial Mathematics

Mod-01 Lec-30 Keynesian economics

History of Economic Theory by Dr. Shivakumar, Department of Humanities and Social Sciences IIT Madras, For more details on NPTEL visit http://nptel.iitm.ac.in

From playlist IIT Madras: History of Economic Theory | CosmoLearning.org Economics

Lec 21 | MIT 14.01SC Principles of Microeconomics

Lecture 21: Capital Supply and Markets I Instructor: Jon Gruber, 14.01 students View the complete course: http://ocw.mit.edu/14-01SCF10 License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 14.01SC Principles of Microeconomics

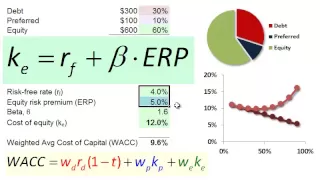

FRM: Weighted average cost of capital (WACC)

WACC is a marginal cost: we can't go to full leverage because the "cost of financial distress" increases the costs of financing. For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist CFA: Financial Reporting & Analysis (L1 , V3)

Ses 17: The CAPM and APT III & Capital Budgeting I

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

MIT 14.771 Development Economics, Fall 2021 Instructor: Ben Olken View the complete course: https://ocw.mit.edu/courses/14-771-development-economics-fall-2021 YouTube Playlist: https://www.youtube.com/playlist?list=PLUl4u3cNGP61kvh3caDts2R6LmkYbmzaG Presents stylized facts about credit

From playlist MIT 14.771 Development Economics, Fall 2021

MIT 14.04 Intermediate Microeconomic Theory, Fall 2020 Instructor: Prof. Robert Townsend View the complete course: https://ocw.mit.edu/courses/14-04-intermediate-microeconomic-theory-fall-2020/ YouTube Playlist: https://www.youtube.com/watch?v=XSTSfCs74bg&list=PLUl4u3cNGP63wnrKge9vllow3Y2

From playlist MIT 14.04 Intermediate Microeconomic Theory, Fall 2020

Risk Management Lesson 7B: Credit Ratings (continued) and Merton's Model

Second part of Lesson 7. Topics: - Credit Ratings: unconditional and conditional PD - Structural models of default. - Merton's Model: basic assumptions and functioning - The PD in Merton's setting - Merton's Model: pros and cons

From playlist Risk Management

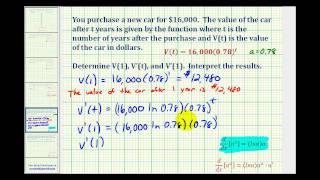

Ex: Application of the Derivative of an Exponential Function (Rate of Depreciation)

This video provides an application problem involving the derivative of an exponential function. It determines the rate of depreciation at a specific time after purchasing a new car. Search Entire Library at www.mathispower4u.wordpress.com

From playlist Differentiation of Exponential Functions

Capital vs. consumer goods and economic growth | Microeconomics | Khan Academy

In this video examine the tradeoff a country faces between allocating its resources towards capital goods or consumer goods, and the impact the country's decision will have on economic growth today and in the future. Microeconomics on Khan Academy: Microeconomics is all about how individu

From playlist Microeconomics and Macroeconomics