Rewriting distance formula in terms of t

In this video we solve for one variable in terms of another.

From playlist Algebra 1 Test 2

Statistics - Find the weighted mean

This video covers how to find the weighted mean for a set of data. Remember that each data point is multiplied by a given weight, and then divided by the total weight. for more videos visit http://mysecretmathtutor.com

From playlist Statistics

The way how to show time using clocks. It is 12 hours video you can use as a screensaver on clock, every number changing is completely random. Please enjoy.

From playlist Timers

Post-analysis temporal downsampling

Are your time-frequency results matrices too big? Watch this video to learn how to reduce the temporal resolution of your results to match their temporal precision, which can save lots of time and space. The video uses files you can download from https://github.com/mikexcohen/ANTS_youtube

From playlist OLD ANTS #5) Normalization and time-frequency post-processing

Time Series Analysis In R | Data Science With R Tutorial

This video talks about, how to use the R statistical software to carry out some simple analyses that are common in analysing time series data. This video tells you how to carry out these analyses using R, rather explaining time series analysis. Here are some important things to know about

Evaluating Time Series Models : Time Series Talk

How do we evaluate our time series models? How can we tell if one model is better than another?

From playlist Time Series Analysis

Time, Speed, Distance Tricks - Variation (GMAT/GRE/CAT/Bank PO/SSC CGL) | Don't Memorise

Using Direct and Indirect Variation is a good way to solve Time, Speed and Distance problems. To Learn More about Time, Speed, and Distance, enroll in our full course now: https://bit.ly/TimeSpeedDistanceWork_DM In this video, we will learn: 0:00 Time Speed Distance formula 0:34 rela

From playlist Time, Speed, Distance, Work (GMAT/GRE/CAT/Bank PO/SSC CGL)

From playlist C. Applications of Differential Calculus

FRM: Exponentially weighted moving average (EWMA)

The EWMA approach to volatility is an improvement over simple volatility because it assigns greater weight to more recent observations (in fact, the weights are proportional). For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Volatility

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Historical simulation (HS VaR): Basic and age-weighted (FRM T4-2)

[here is my xls https://trtl.bz/2BmVoxW] Basic historical simulation value at risk (HS VaR) sorts the returns in the window and locates the return ranked (1-confidence)%*K+1. Age-weighted HS assigns greater weight to more recent returns. 💡 Discuss this video here in our FRM forum: https:

From playlist Valuation and RIsk Models (FRM Topic 4)

FRM: Hybrid historical simulation approach to value at risk (VaR)

Yesterday I illustrated the simple historical approach to estimating value at risk (VaR). Today, using the same 100-day sample of Google's recent daily (periodic) stock returns, I illustrate the hybrid approach. The key idea is: Under the simple, each daily return gets the same weight (1%)

From playlist Value at Risk (VaR): Introduction

Volatility: GARCH 1,1 (FRM T2-23)

[my xls is here https://trtl.bz/2t794bU] The GARCH(1,1) volatility estimate shares a similarity to EWMA volatility: both assign greater (lesser) weight to recent (distant) returns. But the GARCH(1,1) has an additional feature: it models a long-run (aka, unconditional) variance toward which

From playlist Quantitative Analysis (FRM Topic 2)

Level 1 Chartered Financial Analyst (CFA ®): Holding period, money-, and time-weighted returns

Session 2, Reading 7 (Part 2): The holding period return (HPR) is given by [P(t) + D - P(0)]/P(0). The HPR does not account for the time interval, so importantly it is annualized; for example, a 15.50% HPR over 5 years is much less impressive than over one month. The time-weighted return (

From playlist Level 1 Chartered Financial Analyst (CFA ®) Volume 1

FRM: Why we use log returns in finance

Explanation of why we use log returns in finance. For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Intro to Quant Finance

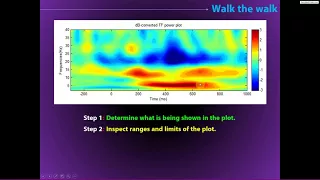

How to inspect time-frequency results

If you are unsure of how to look at time-frequency results, this video has the 5-step plan that you need! It also discusses whether time-frequency features can be interpreted as "oscillations." For more online courses about programming, data analysis, linear algebra, and statistics, see h

From playlist OLD ANTS #1) Introductions

FRM: Time-weighted versus dollar-weighted (IRR) returns

Time-weighted returns (TWR) vs Dollar-weighted returns (DWR). For more Financial Risk Management videos, visit our website at http://www.bionicturtle.com!

From playlist FRM

Volatility: Exponentially weighted moving average, EWMA (FRM T2-22)

[here is my XLS https://trtl.bz/2t1pb9S] The exponentially weighted moving average (EWMA) cures the key weakness of the common historical standard deviation by assigning greater weight to more recent returns and lessor weights to more distant (in the past) returns. Its key parameter is lam

From playlist Quantitative Analysis (FRM Topic 2)