Fin Math L5-3: Towards Black-Scholes-Merton

Welcome to the last part of Lesson 5. In this video we cover some last relevant topics to finally deal with the Black-Scholes-Merton theorem, which will be the starting point of all our pricing exercises. Here you can download the new chapter of the lecture notes: https://www.dropbox.com/s

From playlist Financial Mathematics

Pricing Options using Black Scholes Merton

These classes are all based on the book Trading and Pricing Financial Derivatives, available on Amazon at this link. https://amzn.to/2WIoAL0 Check out our website http://www.onfinance.org/ Follow Patrick on twitter here: https://twitter.com/PatrickEBoyle The Black–Scholes or Black–Scho

From playlist Class 3: Pricing Financial Options

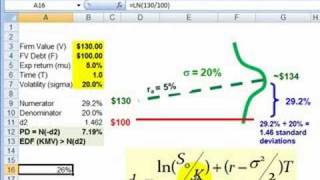

FRM: How d2 in Black-Scholes becomes PD in Merton model

In Black-Scholes, N(d2) is the probability that the option will be struck in the risk-neutral world. The Merton model for credit risk uses the Black-Scholes by treating equity as a call option on firm assets. In Merton, d2 becomes the "distance to default" and N(-d2) becomes the probabilit

From playlist Derivatives: Option Pricing

Low Default Portfolios (Part 1)

A Low Default Portfolio (LDP) is a portfolio characterized by a low number of defaults. Too simple? Citing the BCBS (Basel Committee on Banking Supervision): Several types of portfolios may have low numbers of defaults. For example, some portfolios historically have experienced low numb

From playlist Topics in Credit Risk Modelling

Risk Management Lesson 7B: Credit Ratings (continued) and Merton's Model

Second part of Lesson 7. Topics: - Credit Ratings: unconditional and conditional PD - Structural models of default. - Merton's Model: basic assumptions and functioning - The PD in Merton's setting - Merton's Model: pros and cons

From playlist Risk Management

Discrete Math - 1.2.2 Solving Logic Puzzles

In this video we talk about strategies for solving logic puzzles by reasoning and truth tables. Textbook: Rosen, Discrete Mathematics and Its Applications, 7e Playlist: https://www.youtube.com/playlist?list=PLl-gb0E4MII28GykmtuBXNUNoej-vY5Rz

From playlist Discrete Math I (Entire Course)

Black Scholes Merton option pricing model (FRM T4-11)

[xls to go here] David gives a brief tour of a Black Scholes option pricing model. He highlights three of the questions that we get about this famous model. 1. How are dividends exactly treated? 2. Can we interperet N(d1) and N(d2)? 3. Is there any way to get an intuition about how this Bl

From playlist Valuation and RIsk Models (FRM Topic 4)

Fin Math L6-1: The Black-Scholes-Merton theorem

Welcome to Lesson 6 of Financial Mathematics. This is the lesson of the Black-Scholes-Merton (BSM) theorem. Finally, you might say. But it will also be the lesson of volatility and distortions. A lot of interesting things. In this first video, we focus on the BSM theorem. Topics: 00:00 I

From playlist Financial Mathematics

FRM: Intuition behind the Black-Scholes-Merton

The value of a European call must be equal to a replicating portfolio that has two positions: long a fractional (delta) share of stock plus short a bond (where the bond = strike price). For more financial risk videos, visit our website! http://www.bionicturtle.com

From playlist Derivatives: Option Pricing

2012 FRM Credit Risk Measurement & Management T6.d

This is a sample of our 2012 FRM Credit Risk Measurement & Management T6.d video tutorials. You may view our products here: https://www.bionicturtle.com/products/financial-risk-management/ The Bionic Turtle program is the most effective and affordable preparation aid for the Financial Ri

From playlist FRM

Sixth SIAM Activity Group on FME Virtual Talk

Talk info: Speaker: Jean-Pierre Fouque, University of California Santa Barbara Title: Accuracy of Approximation for Portfolio Optimization under Multiscale Stochastic Environment Abstract: For the problem of portfolio optimization when returns and volatilities are driven by stochastic fa

From playlist SIAM Activity Group on FME Virtual Talk Series

Fin Math L4-2: The two fundamental theorems of asset pricing and the exponential martingale

Welcome to the second part of Lesson 4 of Financial Mathematics. In this video we discuss the two fundamental theorems of asset pricing and we introduce the exponential martingale, an essential tool that we will use as the Radon-Nikodym derivative to move from P to Q in the Cameron-Martin

From playlist Financial Mathematics

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

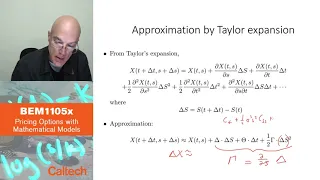

6 1 Black Scholes Merton pricing Part 1

BEM1105x Course Playlist - https://www.youtube.com/playlist?list=PL8_xPU5epJdfCxbRzxuchTfgOH1I2Ibht Produced in association with Caltech Academic Media Technologies. ©2020 California Institute of Technology

From playlist BEM1105x Course - Prof. Jakša Cvitanić

Applied Portfolio Management - Video 4 - Fixed Income Asset Management

All slides are available on my Patreon page: https://www.patreon.com/PatrickBoyleOnFinance Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest

From playlist Applied Portfolio Management

The problem with `functions' | Arithmetic and Geometry Math Foundations 42a

[First of two parts] Here we address a core logical problem with modern mathematics--the usual definition of a `function' does not contain precise enough bounds on the nature of the rules or procedures (or computer programs) allowed. Here we discuss the difficulty in the context of funct

From playlist Math Foundations