Covariance (1 of 17) What is Covariance? in Relation to Variance and Correlation

Visit http://ilectureonline.com for more math and science lectures! To donate:a http://www.ilectureonline.com/donate https://www.patreon.com/user?u=3236071 We will learn the difference between the variance and the covariance. A variance (s^2) is a measure of how spread out the numbers of

From playlist COVARIANCE AND VARIANCE

(PP 4.5) Mean, variance, and moments

Definitions of mean, variance, and moments. A playlist of the Probability Primer series is available here: http://www.youtube.com/view_play_list?p=17567A1A3F5DB5E4

From playlist Probability Theory

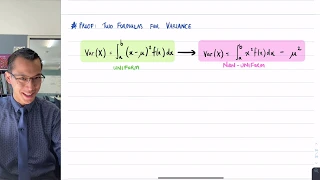

Variance (4 of 4: Proof of two formulas)

More resources available at www.misterwootube.com

From playlist Random Variables

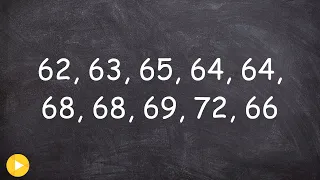

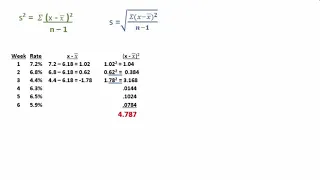

How to find the variance and standard deviation from a set of data

👉 Learn how to find the variance and standard deviation of a set of data. The variance of a set of data is a measure of spread/variation which measures how far a set of numbers is spread out from their average value. The standard deviation of a set of data is a measure of spread/variation

From playlist Variance and Standard Deviation

Derivation.3.Variance as an Expectation

This video is brought to you by the Quantitative Analysis Institute at Wellesley College. The material is best viewed as part of the online resources that organize the content and include questions for checking understanding: https://www.wellesley.edu/qai/onlineresources

From playlist Optional - Derivations

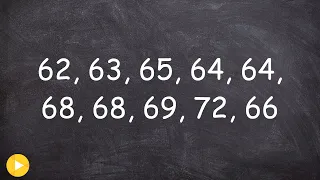

How to find the number of standard deviations that it takes to represent all the data

👉 Learn how to find the variance and standard deviation of a set of data. The variance of a set of data is a measure of spread/variation which measures how far a set of numbers is spread out from their average value. The standard deviation of a set of data is a measure of spread/variation

From playlist Variance and Standard Deviation

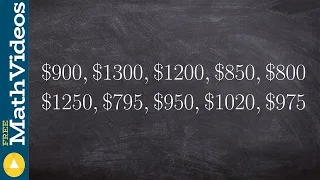

Learning how to find the variance and standard deviation from a set of data

👉 Learn how to find the variance and standard deviation of a set of data. The variance of a set of data is a measure of spread/variation which measures how far a set of numbers is spread out from their average value. The standard deviation of a set of data is a measure of spread/variation

From playlist Variance and Standard Deviation

More Standard Deviation and Variance

Further explanations and examples of standard deviation and variance

From playlist Unit 1: Descriptive Statistics

CLT.4.Variance of Sample Means

This video is brought to you by the Quantitative Analysis Institute at Wellesley College. The material is best viewed as part of the online resources that organize the content and include questions for checking understanding: https://www.wellesley.edu/qai/onlineresources

From playlist Central Limit Theorem

4. Portfolio Diversification and Supporting Financial Institutions (CAPM Model)

Financial Markets (ECON 252) Portfolio diversification is the most fundamental concept of risk management. The allocation of financial resources in stocks, bonds, riskless, assets, oil and other assets determine the expected return and risk of a portfolio. Taking account of covariances

From playlist Financial Markets (2008) with Robert Shiller

MIT 15.401 Finance Theory I, Fall 2008 View the complete course: http://ocw.mit.edu/15-401F08 Instructor: Andrew Lo License: Creative Commons BY-NC-SA More information at http://ocw.mit.edu/terms More courses at http://ocw.mit.edu

From playlist MIT 15.401 Finance Theory I, Fall 2008

Get a Free Trial: https://goo.gl/C2Y9A5 Get Pricing Info: https://goo.gl/kDvGHt Ready to Buy: https://goo.gl/vsIeA5 Create and optimize Conditional Value at Risk portfolios. For more videos, visit http://www.mathworks.com/products/finance/examples.html

From playlist Computational Finance

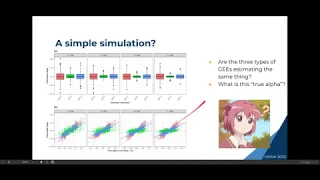

Francis Hui - Spatial Confounding for GEEs

Dr Francis Hui (ANU) presents "Spatial Confounding for GEEs", 19 June 2020.

From playlist Statistics Across Campuses

Math 176. Math of Finance. Lecture 07.

UCI Math 176: Math of Finance (Fall 2014) Lec 07. Math of Finance View the complete course: http://ocw.uci.edu/courses/math_176_math_of_finance.html Instructor: Donald Saari, Ph.D. License: Creative Commons CC-BY-SA Terms of Use: http://ocw.uci.edu/info More courses at http://ocw.uci.edu

From playlist Math 176: Math of Finance

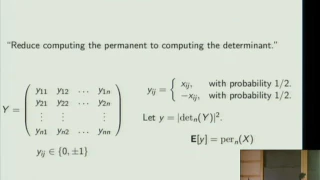

The Complexity of the Non-commutative Determinant - Srikanth Srinivasan

The Complexity of the Non-commutative Determinant Srikanth Srinivasan Institute for Advanced Study October 11, 2010 I will talk about the computational complexity of computing the noncommutative determinant. In contrast to the case of commutative algebras, we know of (virtually) no efficie

From playlist Mathematics

Stochastic thermodynamics and its applications in the study of microscopicactive by Sourabh Lahiri

ABSTRACT Tiny heat engines at nanoscales have become a topic of intense studies in recent years. Such engines can be used to power nanomachines. Such machines can find a lot of applications, especially in the medical industry. Recent studies show that it may be possible to enhance the effi

From playlist Seminar Series

Risk Management Lesson 4B: Volatility (second part) and Coherent Risk Measures

This is the second half of Lesson 4. Topics: - Exercise about volatility modeling with G-arch - Coherent risk measures - Are the variance and the standard deviation coherent? A useful document for you is available here: https://www.dropbox.com/s/6pdygf0bw6bcce1/coherence.pdf

From playlist Risk Management

Level 1 Chartered Financial Analyst (CFA ®): Sampling and Estimation

In this video, I'm looking forward to sharing highlights with you from the CFA section, sampling and estimation. Sampling and estimation in statistics are theoretically essential and foundational, but in actual practice, it's very important. This is the practice of using samples to draw in

From playlist Level 1 Chartered Financial Analyst (CFA ®) Volume 1

Derivations.2.Derivation of Variance

This video is brought to you by the Quantitative Analysis Institute at Wellesley College. The material is best viewed as part of the online resources that organize the content and include questions for checking understanding: https://www.wellesley.edu/qai/onlineresources

From playlist Optional - Derivations