Introduction to Econometrics Toolbox in MATLAB

Get a Free Trial: https://goo.gl/C2Y9A5 Get Pricing Info: https://goo.gl/kDvGHt Ready to Buy: https://goo.gl/vsIeA5 Create a predictive time-series model of a stock index. For more videos, visit http://www.mathworks.com/products/econometrics/examples.html

From playlist Computational Finance

2. Utilities, Endowments, and Equilibrium

Financial Theory (ECON 251) This lecture explains what an economic model is, and why it allows for counterfactual reasoning and often yields paradoxical conclusions. Typically, equilibrium is defined as the solution to a system of simultaneous equations. The most important economic mode

From playlist Financial Theory with John Geanakoplos

Linear regression is used to compare sets or pairs of numerical data points. We use it to find a correlation between variables.

From playlist Learning medical statistics with python and Jupyter notebooks

A solar system, a simulation made with Excel

An Excel simulation of the solar system. You can see how things are recursively computed: the mutual gravity force from the locations, the accelerations, the velocities, and finally the updated locations. The solar eclipse is also shown. This is clip is intended to illustrate Chapter 24 Ap

From playlist Physics simulations

Jean-Pierre Florens: Inverse problems in econometrics - Lecture 1/4

Recording during the thematic month on statistics - Week 2 : "Mathematical statistics and inverse problems" the 9 February, 2016 at the Centre International de Rencontres Mathématiques (Marseille, France) Filmmaker: Guillaume Hennenfent Find this video and other talks given by worldwide

From playlist Probability and Statistics

Evaluating Time Series Models : Time Series Talk

How do we evaluate our time series models? How can we tell if one model is better than another?

From playlist Time Series Analysis

Financial Theory (ECON 251) Our understanding of the economy will be more tangible and vivid if we can in principle explain all the economic decisions of every agent in the economy. This lecture demonstrates, with two examples, how the theory lets us calculate equilibrium prices and all

From playlist Financial Theory with John Geanakoplos

Threshold Switching Models | Switching Models in Econometrics, Part 2

This is the second video in a two-part series that shows how to model time series data in the presence of regime shifts in MATLAB in this video, we use Threshold Switching Models from the Econometrics Toolbox to model inflation data across different inflationary regimes. Download the code

From playlist Switching Models in Econometrics

Markov Switching Models | Switching Models in Econometrics, Part 1

This is the first video in a two-part series that shows how to model time series data in the presence of regime shifts in MATLAB. In this video, William Mueller uses Markov switching models from the Econometrics Toolbox to model unemployment data across different economic regimes. Downloa

From playlist Switching Models in Econometrics

Stanford Seminar - Combining Physical and Statistical Models in Projected Global Warming

EE380: Computer Systems Colloquium Seminar Combining Physical and Statistical Models in Order to Narrow Uncertainty in Projected of Global Warming Speaker: Patrick Brown, Carnegie Institution for Science at Stanford A key question in climate science is How much global warming should we e

From playlist Stanford EE380-Colloquium on Computer Systems - Seminar Series

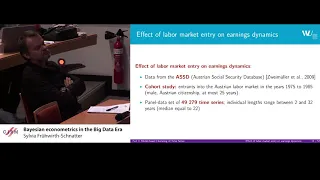

Sylvia Frühwirth-Schnatter: Bayesian econometrics in the Big Data Era

Abstract: Data mining methods based on finite mixture models are quite common in many areas of applied science, such as marketing, to segment data and to identify subgroups with specific features. Recent work shows that these methods are also useful in micro econometrics to analyze the beh

From playlist Probability and Statistics

Machine Learning and Economics: An Introduction

Professor Susan Athey presents a high-level overview contrasting traditional econometrics with off-the-shelf machine learning.

From playlist Machine Learning & Causal Inference: A Short Course

Simulating the economy as we simulate the climate... - Pollitt - Workshop 3 - CEB T3 2019

Pollitt (Cambridge Econometrics) / 04.12.2019 Simulating the economy as we simulate the climate: why most economists get it wrong ---------------------------------- Vous pouvez nous rejoindre sur les réseaux sociaux pour suivre nos actualités. Facebook : https://www.facebook.com/I

From playlist 2019 - T3 - The Mathematics of Climate and the Environment

Jean-Pierre Florens: Inverse problems in econometrics - Lecture 2/4

Recording during the thematic month on statistics - Week 2 : "Mathematical statistics and inverse problems" the 9 February, 2016 at the Centre International de Rencontres Mathématiques (Marseille, France) Filmmaker: Guillaume Hennenfent Find this video and other talks given by worldwide

From playlist Probability and Statistics

Jean-Pierre Florens: Inverse problems in econometrics - Lecture 3/4

Recording during the thematic month on statistics - Week 2 : "Mathematical statistics and inverse problems" the 10 February, 2016 at the Centre International de Rencontres Mathématiques (Marseille, France) Filmmaker: Guillaume Hennenfent Find this video and other talks given by worldwide

From playlist Probability and Statistics

Regional Climate Projections and High-Resolution Economic Modeling

Tony Smith, Yale, delivers a lecture entitled, "Regional Climate Projections and High-Resolution Economic Modeling", during the YCEI conference, "Uncertainty in Climate Change: A Conversation with Climate Scientists and Economists". More at yale.edu

From playlist Uncertainty in Climate Change: A Conversation with Climate Scientists and Economists

Parametric and nonparametric tests

Parametric tests are most commonly used in healthcare research. They include tests such as Student's t-test and ANOVA. There is, however a rich set of non-parametric tests that are much more appropriate to use in certain circumstances.

From playlist Learning medical statistics with python and Jupyter notebooks